This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Let’s start with a quick review of what happened over the past weeks.

Since Apr 2nd, price entered a deep and quick sell-off, taking major equity indexes into a bear market, down more than 20% from the start of the weakness back in Feb.

During that crazy first week of April, SPX and Nasdaq each fell around 10% in two days, with absolutely panic among most investors. CNBC fear and greed index stayed in extreme fear for a few days straight with 2 or 3 days in a row showing numbers like 4 or 5.

That was extremely unusual.

Then over the weekend of 4/5 and 4/6, many prominent people in the financial world started to make public call-outs to the administration, urging for a 90 day pause on proposed tariffs.

On 4/7, there was a rumor during the day that there was gonna be a 90 day pause. But WH said that was fake news. So the bounce didn’t really work.

On 4/9 however, they came out and say “hey actually we are going to pause this for 90 days”. And stocks ripped. Nasdaq rallied *12%* in a single day. Even SPX was up more than 10%. Many stocks, especially tech stocks, all posted double digit returns on that day.

And that marked the low of the market so far.

During that same week, there was something else unusual going on.

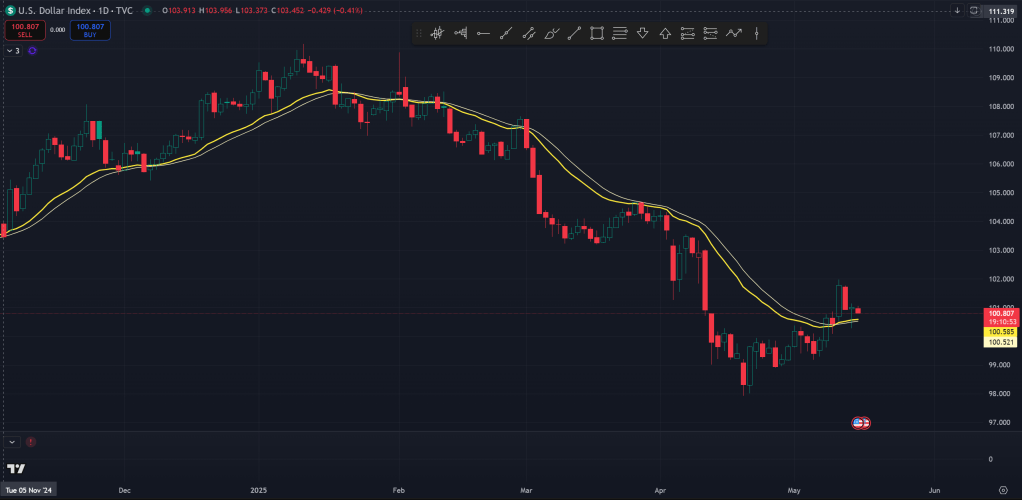

The 10 year treasury yield rose from around 3.9% on 4/7 to hit a high of 4.6% that Friday 4/11. The dollar index also registered a drop of more than 4% over that single week, weakening against a basket of currencies.

Usually, when the risk is high (high volatility) in the equities market, people tend to seek shelter in US treasuries, as those are deemed “risk free” assets. After all, nobody expects the US government to default on its debt, so it is a guaranteed investment.

This time around however, US treasuries got sold off, along with the dollar itself, while gold rallied nearly 10% that week and stocks also posted gains of more than 10% on the week, basically hanging on to the 4/9 rally gains.

This price action is signaling to us that there is an imbalance of sellers in US treasuries, US dollars while an imbalance of buyers in gold and stocks.

One can say stocks rallied because it simply dropped too much and the sentiment was too negative, there simply wasn’t anyone left to sell anymore.

But the fact that treasuries and dollar got sold off while gold rallied, somehow signals to me that there is a growing anxiety around the US’s ability and willingness to service and repay its debt, seeing that the pile is just too big all the while the administration appears to be strong-arming the globe.

With that there might also be an anxiety around the dollar’s reserve currency status as well, seeing that the administration seemingly wants to remove all trade deficits, which goes against the requirements of a global reserve currency. Hence the sell-off in the dollar and the rally in the gold. Which could also help explain why stocks could rally, since if I anticipate the dollar to be losing its value, I might as well invest it into quality stocks that can perform as a hedge against currency debasement. Also BTC rallied 13% over that week too and has extended much further over the weeks until now.

All of that is to loop back to today, where we are currently.

After a month, price (using MES price because that’s what I follow) has made it all the way back to before liberation day levels, and in fact is now above the March bounce high.

This is a rally of 23% over the course of 27 trading days, with a 10-day stretch where price never made a down day from Apr 22 to May 2. This is quite frankly a head-spinning rally.

Which begs the question, where do we go from here?

To me, in the short term, price seems a bit stretched as it is pretty far away from the key 21 EMA that I use as a reference. But this is not saying that I expect price to go down much from here.

What happened this week, or rather over the weekend, was that the deal between US and China was much, much better than expected. Everyone was kind of thinking, “oh they were talking shit to each other over the past weeks, there’s no way the first talk is gonna be productive.” Which explains the sluggishness and overall indecision over the last week, as price also was stuck between some longer term EMAs.

Came Sunday and both sides said it was an honest and productive talk, so people could get in fast enough. Came Monday morning when people learned the full details of the deal, it just went higher from there.

Over the past 3 days, price has been incredibly resilient, refusing to go down even after a open gap higher on Monday for the cash index. This to me feels like something fundamental has changed, basically saying that this whole thing might actually never happen and it really is just a scare. And so we are back to square one and as long as corporate earnings and the economy does fail we should be good.

But technically it is a bit stretched, and I noted how SPX 5900 level was presenting some trouble for price while ES 5900 served as a level where buyers got to work today. What I would like to see is for price to go back to the 21 EMA, either on a pullback or some sideways movement. But nobody knows what’s gonna happen and I certainly have no say in what price will do.

With this most recent US-China deal rally and the fact that we are stretched, I’m seeing people saying that the market will crash again and that they are holding strong on their shorts. I’m also hearing that with this bounce over the past weeks, it was mainly retail buying while hedge funds stayed mostly on the sidelines.

If this is true, then I suspect we could see a final push higher on some kind of catalyst, for example PPI and retail sales tomorrow, or the Powell speech at 8:40 EST tomorrow, to finally make the bears cave in and trap late bulls, before price stages a pullback to hit the EMA.

To conclude, the way I see it is that price is on track to resume the bull trend, and this whole thing could just be a giant pullback on a single event shock. Now that the shock is away, as long as there’s no real damage to the economy and to the corporate profitability, it should be all good.

Regarding the potential case for dollar debasement, I’m not sure what it will do to the economy, but so far it doesn’t seem to impact US consumers and corporate profitability, and if anything might just lead to a weaker dollar. Not sure what happens if US defaults but so far it’s hard to imagine we come to that. A debased dollar might be further case for owning stocks or bitcoins or gold or even real estate.

Technically, price has flipped above the EMA and holding strong. I read in price action that the trend that gives you an urge to get in and you are constantly waiting for a pullback to get involved is the strongest and most frustrating type if you are out. I think this is that kind of trend.

But I won’t be chasing here, since SPX 6000 is not that far away, and my policy tells me to wait for a pullback and preferably around the EMA. Though I accept that price might go even higher from here and look increasingly strong and parabolic. I will hold my urge to get in on that strong breakout, knowing that it might be the final push higher in this leg.

Trade at your own risk.

The Ephemeral Tourist

May 14. 2025 @ 11:40pm CST