This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

In Thursday’s note, I remarked that I expected higher prices to be more likely than lower. And this was what happened for Friday as we got another bullish trend day during regular trading hours.

The day went on without much impactful economic data or news events, except for the University of Michigan consumer sentiments report and a Moody’s downgrade of the US credit ratings late in the day after cash session terminated.

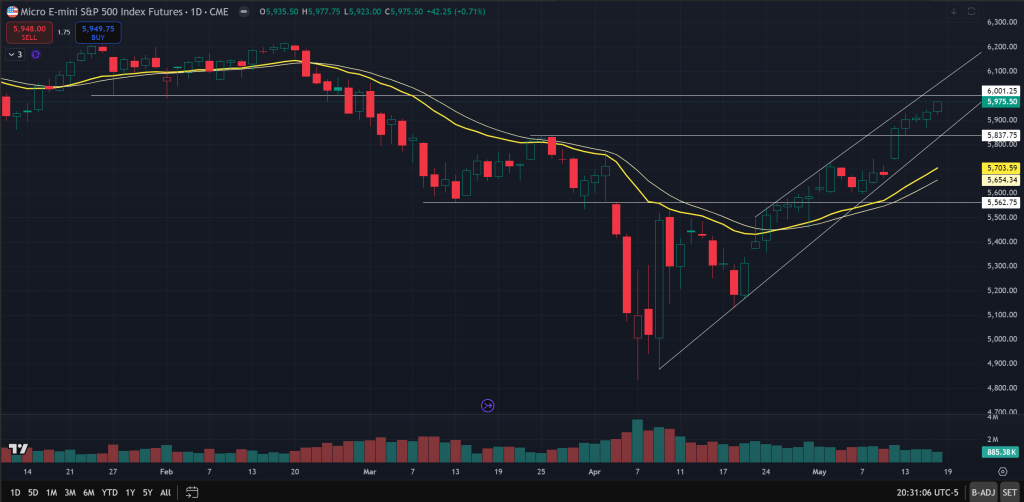

The consumer sentiment report caused some selling in the immediate aftermath but that selling attempt was quickly negated by buyers stepping in. Buyers got even more aggressive once price broke down below the EMA in an attempt to reverse the trend. Buyers were able to form a 2-bar reversal and followed up with more buying to get price back above EMA, making the sell-off a failed break down attempt.

As soon as price was able to come back from that failed breakdown attempt to reverse price, either buyers started buying every small dip or sellers simply stepped aside or maybe a combination of both played out, as price was able to form a relatively uninterrupted uptrend channel for most of the day.

At around 2pm, after consecutive bull bars albeit small and with moderate overlap but trending higher highs and higher lows, price formed a small breakout with higher volume that was met with selling, likely in the form of profit taking.

This selling went on for a few bars until 15 minutes until cash close when buyers reemerged once price broke down below the EMA again, rejecting the attempt to breakdown and taking price back to the high of the day.

All was well during the cash session, and price looked poised to make an attempt for 6000 next week.

However, a notable development happened close to the 4pm futures market close when Moody’s decided to downgrade US credit ratings. This caused a very quick and strong sell-off in equities, essentially wiping off the entire day’s worth of rally, as this caught everyone by surprise and was likely exacerbated by the lower liquidity in the late trading session.

With this sell-off that happened late day on a Friday, with a whole weekend for sentiments to potentially sour, there is now a concern if price can make a direct attempt of 6000 without testing down first early next week. The sell-off also of course impacted the US treasuries and dollars as well.

And to be fair, the consumer sentiment report isn’t all that great either, with sentiments worse than expected while inflation expectation higher than expected. Retail sales on Thursday also was weak compared to previous month.

Maybe now it’s time for the fear for a potential recession to come back? What about the damages already done by the tariffs or the anticipation of such, as well as the potential debasement of dollar and the questions about the creditworthiness of US debts, now that the administration is seen to have limited policy stability and has lost the highest ratings from all three credit ratings agency?

Although price did not yet make a climactic top with high volumes and potential breakout attempts past 6000 to lure in late buyers, this Friday development could be the turning event that marks the high of the epic bounce from April low. The market’s strong selling reaction to the ratings downgrade is the first sign of trouble, but we will have to wait and see what happens on Sunday futures open and on Monday to see how price reacts to this to be sure.

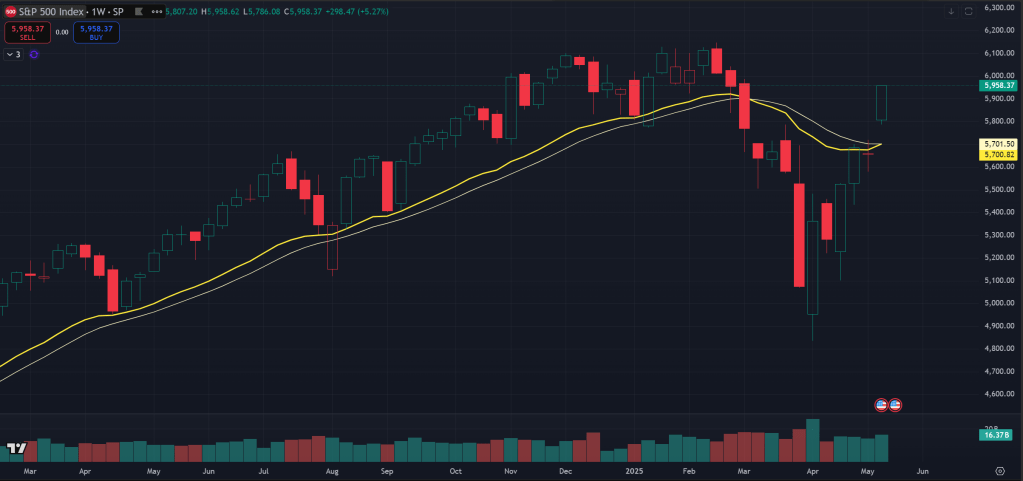

Also to touch on the weekly of the SPX index. Price made a strong bullish trend bar today with a decent sized gap up that did not get filled, stemming from last Sunday night’s futures rally from the US China trade deal that was very much beyond the market’s best expectations.

On the weekly chart, this week’s bar is a bull breakout bar that has yet to test the EMA which it broke out from to confirm that it’s valid. Although if the sell-off earlier this year is just a bull market correction then price need not necessarily test down. In fact, it can do absolutely whatever it wants if other market participants allow it.

But if price did sell off over the next or coming weeks to below the bar and more importantly below the EMA, the outlook will be back to that we are in a bear market and price just made a huge break DOWN retest of the EMA to confirm that the overarching bull trend has likely shifted into a bear trend. So far we have no confirmation of either yet.

The EMA level on the weekly SPX is around 5700. On the day chart for the futures, that 21 EMA is about 5700 as well, although the futures and index is about 20 points different now but that 5700 level seems to be the line in the sand here. That is also the place I will be expecting some pretty strong buying interest if we get there, even if the entire April/May bounce is just a bear market rally.

In conclusion, I currently view the market as more neutral with a slightly downward bias, compared to the more likely to be higher than lower stance on Thursday. This change is driven by the late day Friday Moody’s downgrade and price’s reaction to it, as well as the myriad of potential issues that could be back on people’s minds over the weekend, now that we have this downgrade and late sell-off.

However, the technical trend is still up without a concrete sign of top yet. We will need to watch Sunday night’s futures action and Monday’s regular session to see how people take this. If we confirm a short term top, I expect price to go down to at least test the EMAs, currently in confluence at around 5700. Price could get one final push higher to 6000 but with the development I view that as more unlikely. 5700 or the EMA to be exact will likely be key in determining if the epic bounce is a bear market rally or if we are truly resuming the bull market.

The Ephemeral Tourist

May 18. 2025 @ 12:04am CST