This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

In Saturday’s post, I said I was now anticipating slightly higher chance of lower price before higher price, due to the Friday late day credit downgrade and the market’s reaction to the news.

Well, we got some of that overnight but during the day, let’s just say dip buyers came out in full force. I was certainly expecting more from bears than whatever half-assed attempt they made at shorting today.

Price sold off overnight but as soon as Europeans joined the chat, the sell-off stalled and price actually started turning higher with EMA flipping higher as well.

This sustained until the US cash open, and when the attempt to break it down starting from 8:10 to resume the bear trend failed, as seen by consecutive higher lows in candles leading up to the open, price just ripped.

The speed and determination of the spike could be due to weak bears just deciding to get out on a good sized weekend gap down, and since EMA is far up on the RTH chart that could be a good call. The spike also perhaps caught a good bunch of people by surprise too (I for one did not expect such strong action). As price spiked relentlessly, more and more bears conceded and bulls embolden because an imminent sell-off appears less and less likely, in turn fueling the rally.

After the spike ended at 9:10, price entered a bull channel, generally riding the EMA from ETH chart as well as the RTH chart. There was another push around 12pm for price to almost hit 5990 but we didn’t quite get 6000 on either the futures or SPX index chart. We did however overshoot Friday’s high at around 5977.

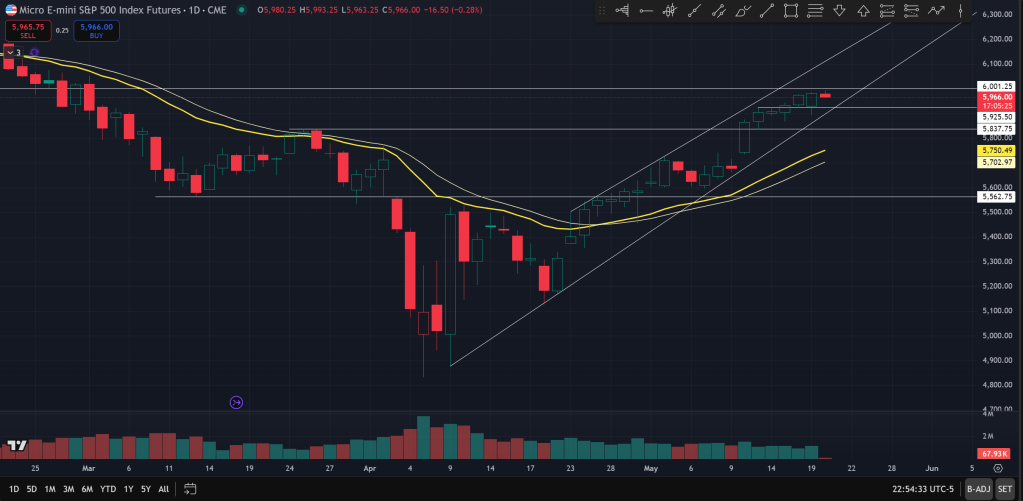

All told, price made another bull trend bar on the daily chart and it’s actually a bull outside bar since price made a lower low on the open and the rallied straight up for the first half hour to 45 minutes then trended up in a channel to a slightly higher high but shy of 6000 before mostly sidelining for the rest of the afternoon.

This by itself is a fairly bullish development and shows that bulls are still firmly in control and are willing to buy on any dip even tiny dips like today’s and sustain that control over the day.

However, as I keep beating on the dead horse that there are a few things giving me pause. One is that price is far away from the EMA and extended with 6 consecutive bullish bars in a row now. Additionally, we are very close to the 6000 level which could be a level where longs who held onto gains might be looking to increasingly offload some positions. Also note that price did not go far above today’s high and in the overnight session right now price has fallen about 0.3%.

There’s also a bit of psychology at play here too. Since the bounce from the bottom on 4/7 and 4/9, price has made significant progress, up more than 20% from the low. Along the way there’s been constant calls for a second leg down and that price will go back to bear market and recession and whatever doom and gloom scenario. People are out of position and waiting on the sidelines for either a pullback to long or perhaps establishing shorts on signs of weakness.

However, what we are getting is just constant bull bar melt-ups and even on days like today with gap downs we get a huge reversal back to the highs. This is extremely frustrating to those out of position or those currently in a short. They have to constantly make the decision whether they stay short or exit now or get involved now, which could explain the ferocity of today’s opening rally, as some of them simply cannot hold out anymore.

Remember how market tops and bottoms could happen on climactic moves where price made a strong bullish or bearish trend bar, causing those on the wrong side to finally capitulate and those on the sidelines to finally enter. If price fails to generate follow-through in that direction for whatever reason, maybe some strong hand decided to exit on a profit, price could quickly reverse, because those entered on the last leg are weak hands and also because there’s not many more left to be waiting to buy or sell in the old trend’s direction.

Could this be what’s happening? I’m not sure. It certainly doesn’t feel like the risk reward is going to be good if you go long here. But again, the trend can go on much longer than you can stay afloat.

Today’s price action is bullish when looking at it out of context. Seen together it’s a bit more complicated. I would be watching closely the 6000 level and also today’s high and see how price interacts with the levels.

If I have to guess, I would say price would not go far above 6000 even if it’s able to hit it. And even if price closes above 6000 on a bull day, there still is the risk that But for price to be setting a top, bears must be able to at least form a bearish day candle to show some strength. I am maintaining my stance that I would not like to chase long here but instead would be more interested as price got down to the EMA on the day chart, currently around 5700-5800, or at least have price go sideways for some time for EMA to catch up.

The Ephemeral Tourist

May 19. 2025 @ 11:36pm CST