This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Today bears were finally able to come out and somewhat overwhelm bulls in making it a bearish day. However, despite today ended as a bear day, price rallied into the close which is a show of force by the bulls.

Price opened lower with a small gap down on the day then proceeded to attempt lower auction but was met with consistent buying pressure below the opening candle low. Price traded above the EMA but was quickly shot down again and possibly triggered stop losses on bulls who bought the breakout.

Price generally remained slow and difficult with lots of sideways action and overlapping bars as there was no significant news or economic data to break the balance.

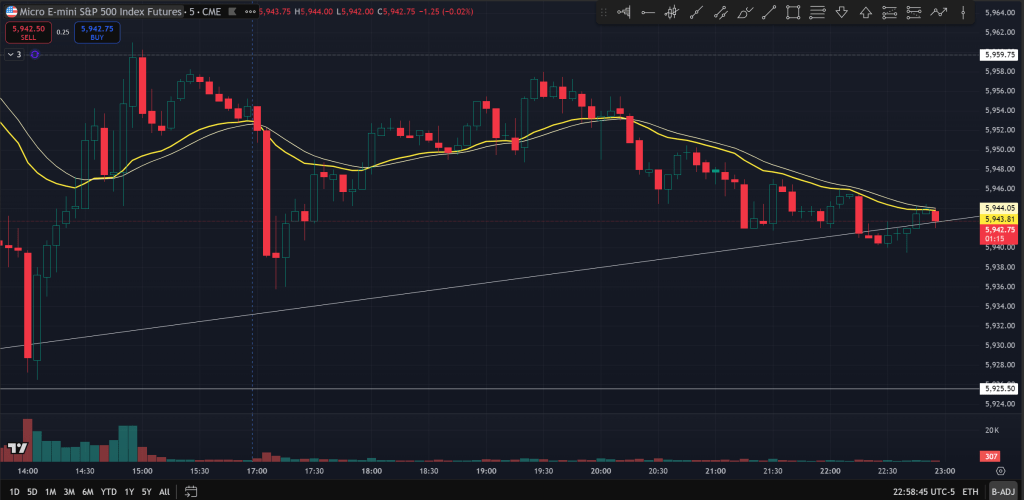

At around 1:15pm, price staged a breakdown with elevated volume from the EMA. This could be the result of extended chop and as price made lower swing highs that both acted as failed breakouts of the opening level, and then price stayed under EMA for several bars without success in reclaiming it.

Either way, with the strong spike down, price was likely to form a 2nd leg down which it did after a small wedge bear flag failing to bounce higher towards EMA. Price broke down to hit the bull trend line support at around 5926 then promptly bounced. Note how this broke down bear trend bar had very high volume as well.

The speed and size of the bounce was both very strong and with the high volume of the previous bar likely meant price made a final bear flag and the sell-off was already climactic. As soon as price got above the final bear bar high, bears lost the control of the action and price staged a few consecutive bull bars to test the EMA and eventually broke above it and held it. Note also that the final 10 minutes of the cash session price rallied to close at around the low of the opening bar.

Soon after the overnight session started, price sold off with a large bear bar on some geopolitical news, which was promptly reversed initially. Price later dropped again and is now close to the EMA and around the bull trend line support.

Overall today was slow and difficult without much new development. One thing of note is how high the volume was compared to other bars during the afternoon sell-off and later bounce. This suggests significant indecision and balance between bulls and bears as there appears to be valid reason for both a rally higher at least towards 6000 and for a sell-off to test down the EMA or at least some sideways action.

As price drifts sideways to higher, the retest pullback if any will also have gradually higher targets. Instead of 5700, I now view 5800 as a potentially good spot to add to exposure if we get there.

However, with the strong buying pressure, we might even get 6000 first before a pullback to test the EMA or price may just stick around sideways for EMA to catch up. Either case, I will be maintaining the plan to add to exposure when price gets back to EMA and on signs of strength for resumption of bull trend.

The Ephemeral Tourist

May 20. 2025 @ 11:05pm CST