This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

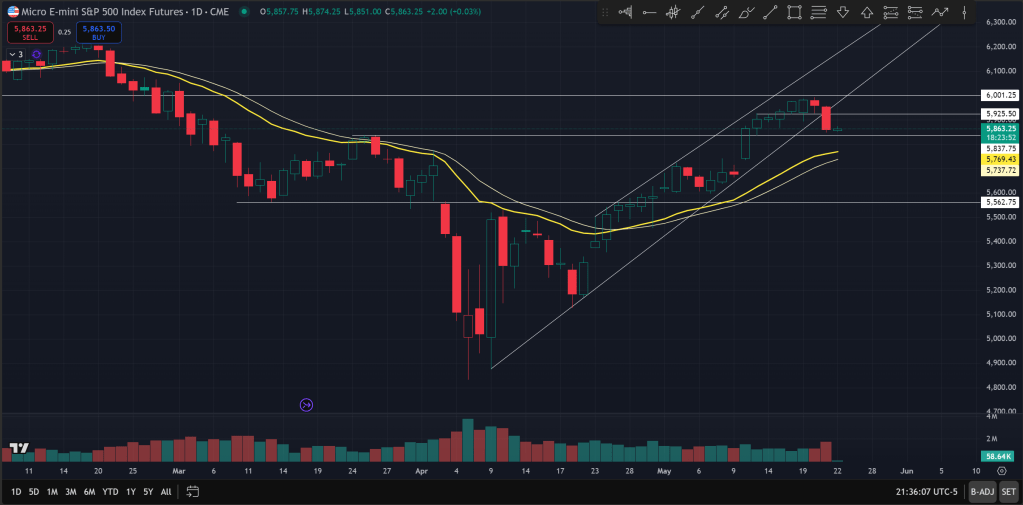

On a day with lackluster 20 year bond auction, equities appear to have finally paid attention to what treasuries have been saying. Bears finally came out of hibernation (or maybe bulls ran away) mostly in the afternoon, and staged a decently sized bear trend bar that closed on its lows.

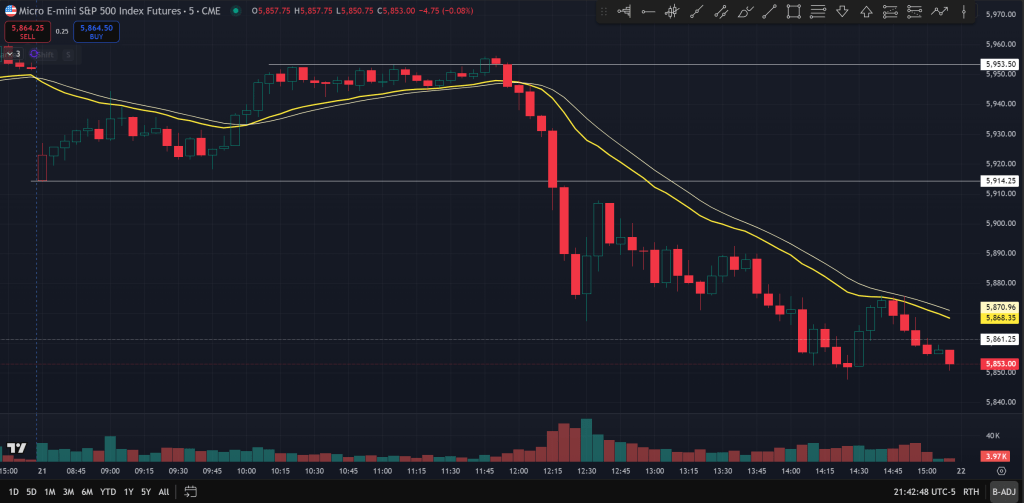

Zooming in a bit we can see the impacts from this 20yr bond auction at 12pm. Before the auction, price opened gap down but then bounced with decent buying pressure, very similar to what we have seen over the past few days.

This bounce looked so convincing that I took off my put protection, thinking that price may not be staging a sell-off to test the EMA but will likely choose instead to just chop sideways for EMA to catch up. Note also how price rode the EMA leading up to the 12pm auction, looking very poised to a breakout higher.

We did get that breakout at around 11:50 above 5950, but it was quickly met with selling while buyers did not find buying above of interest, resulting in a failed breakout attempt of the chop. Note also how that 11:55 bar already formed a decently sized bear bar closing on its low and below the EMA ahead of the 12pm bond auction.

What happened at 12pm or rather 1 minute after 12 was the 20 year US bond auction, which sold at a high yield of 5.047%, tailing the when issue yield by 1.2bps. For a bit of reference, the high of the US 20 year bond yield was around 5.4% back in October of 2023. Now after 100bps of cuts to the Fed funds rate, we are now just 40bps below that recent peak. For the 30 year yield, it was even worse as the peak was about 5.2%, and we are currently at 5.1% at the high today.

Now I’ve not studied treasuries and interest rates extensively, but yields staying high like this along with a weakening dollar is certainly saying something about investors’ appetite of US credit. Why, I wonder, with the so far not-succeeding tariff plan to have the world bow down as well as the proposed tax cuts which will only add to budget deficits, are we seeing this?

After that tepid auction, with the prior failed breakout and the weakness that was already there right before the auction, price quickly fell around 1.5% (about 90 points for the ES) in a span of about 30 minutes, to go all the way back down below 5900 to hit 5860.

And the put I just got rid of this morning had a decent bump in its value. And to add salt to the injury, I’ve had this put for about a week, so basically I held through the sideways up grind but gave up right before it pays. Oh well. Such is life.

This also kind of highlights how deceitful market price action can be, and how easily a breakout or whatever pattern that is setting up can fail and reverse to the other side.

Anyways, I digress. The sell-off then got a bit climactic and bounced about 40 points, but since the sell-off spike was very strong relative to recent action, price of course had to bull trap and trade sideways to down for another leg. Though after the spike there was a lot of 2-sided overlapping action, but price generally stayed depressed by the EMA with a late day test of that EMA promptly failed into the close,

With today’s sell-off, we are finally correcting some of the stretched and overbought conditions, with price now about another 1.5% above the EMA. Like I said, I will be looking for signs of buying pressure if and when we get there. Right now price appears to be on track to have a bit of corrective action, with that 6000 level test likely put on hold for now.

Note also that price could go down further below EMA, for example to hit 5730 and SPX 5700 level to close the weekend gap from last week. Again I view it more likely that price is now on track to resume the bigger uptrend instead of this 20% bounce being a bear market rally, so will be interested to add exposure if there are signs of correction ending.

The Ephemeral Tourist

May 21. 2025 @ 10:36pm CST