This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Following yesterday’s bearish trend bar, instead of bearish follow-through, what we got is a slightly bearish doji with a very small body. This likely is a potential disappointment for a lot of bears waiting for stronger break down action.

Price is now fairly close to the EMA on the daily chart. Seeing today’s relative strength in the price action as it did not continue the sell-off, I added a tiny bit of equities exposure in the morning, on the off chance that price is very strong and will stage a reversal soon and consider this tiny sell-off as sufficient test of the EMA.

More likely than not though, is that we have at least another day of bearish trend day, potentially undercutting the EMA to look like it is going to break down. If that happens I will be watching very closely for signs of pull back ending/bottoming. Price could also dip into the US-China trade war truce weekend gap but never really close it before finding buyers, so I view the 50-point zone from 5730 to 5780 to be likely to see buyers.

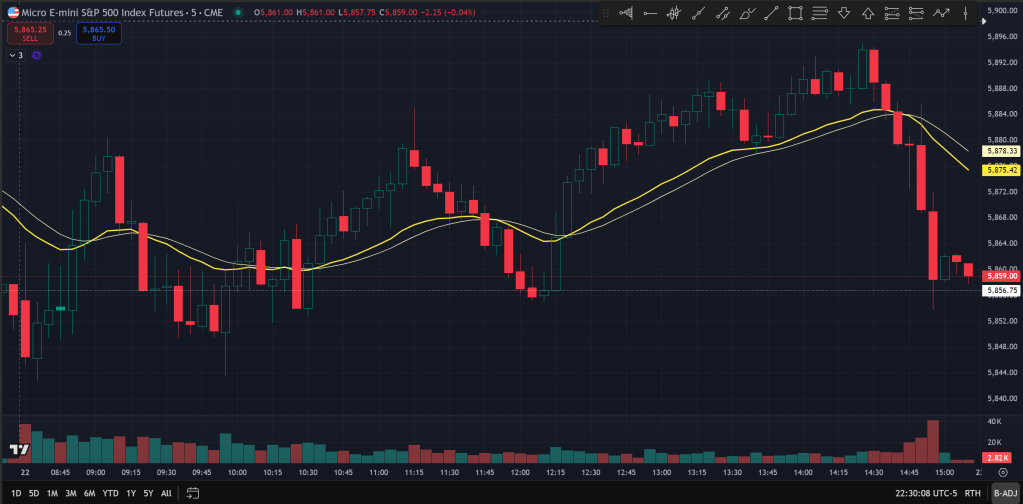

Zooming into the RTH 5 minute chart for today, we can see that price ended up forming a trading range day while most of the day it had a slightly bullish drift with higher swing lows and highs.

This bullish drift ended near the end of cash session, as price failed to breakout higher to test 5900 (came just 5 points shy at 5895) after riding the rising EMA. Note this peak happened at 14:30 and the 2-bar reversal formed a failed breakout for the bulls, causing bulls to exit and bears to be emboldened.

What’s interesting was at 14:50, price initially jumped but quickly came down as selling overcame buying. This triggered more selling and price made 2 relatively large bearish trend bars that closed on their lows for the final 2 bars leading to cash close. I view this as a fairly bearish sign, suggesting strong and potentially institutional selling at the end of the day. So I put on some put as a protection in case we get a bearish 2nd leg follow-through day tomorrow.

Tomorrow will also be the last trading day before the long weekend. US markets will be closed next Monday on 5/29. I expect tomorrow to see lower auction, potentially hitting EMA and even undercutting and could even turn out to be climactic.

The sign I will be waiting for is a stronger bearish trend bar to indicate climax, which we might get once we get under EMA. Then I’d like to see reversals of that climax, either in the form of a bull reversal bar closing off lows or a 2-bar reversal. Dojis will be less ideal but could also work. Either way, I view price as close to pullback target but likely not quite there yet, judging by the late day sell-off.

The Ephemeral Tourist

May 22. 2025 @ 10:40pm CST