This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

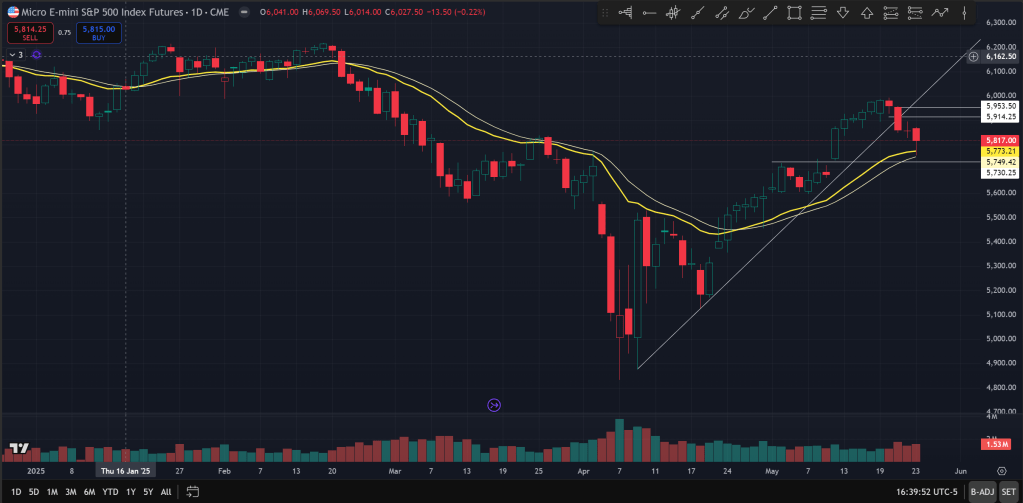

On Friday, price was able to fully hit the EMA on the day chart due to some tariff news. Price hit the EMA and bounced for most of the day following the morning’s open gap down, before some selling once again at the end of the day.

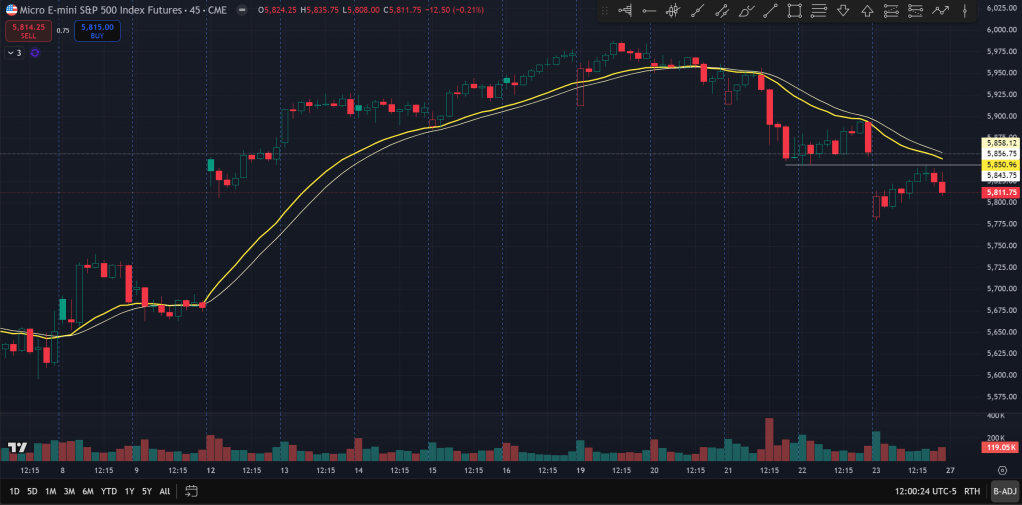

Zooming in to the intraday RTH chart, one can see that the bounce was not particularly strong. It happened with a lot of overlapping candles and 2-sided actions, suggesting a more cautionary tone from bulls.

This bounce could also very likely have come from bears taking profits on finally some relatively strong bear moves. One can also see that the price neatly hit Thursday’s low and rejected that level, unable to get above to reclaim the level.

Overall, the development was more neutral than bullish. It wasn’t the type of sell climax I was waiting on and the bounce simply means that at least a good number of people are willing to buy at the EMA, which is reasonable given the strength of the Apr/May bounce.

However, the late day selling in the final 10 minutes of cash trading is giving me some pause. It could be because this weekend is a long weekend, and people aren’t willing to hold over the 3-day weekend, in case there’s any further negative development in terms of trade deals and tariffs. Or it could be that price usually doesn’t like to do the most obvious thing. Either way, I would like to see a bit more strength to convince me of the end of the pullback.

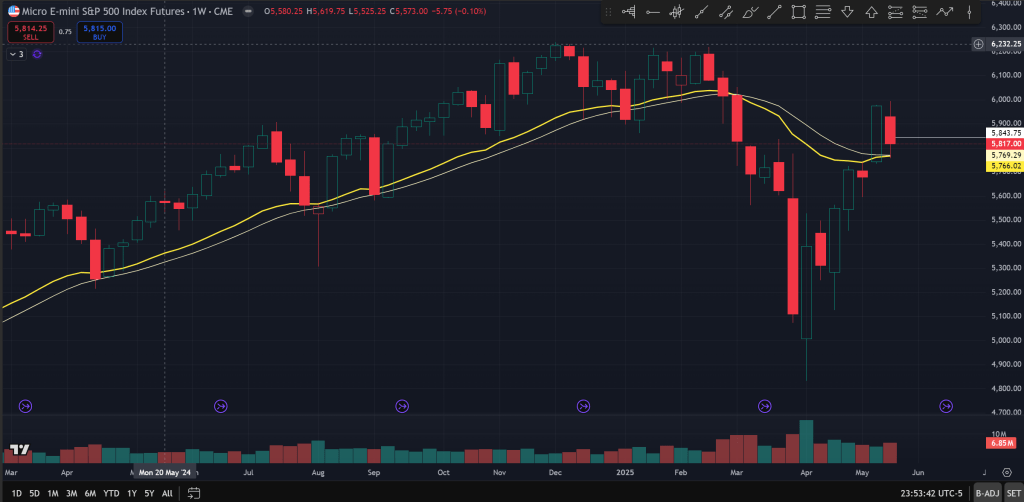

Now if one looks at the weekly chart of the futures, it’s obvious that the week’s price action is doing some amount of damage to the bounce. Price almost entirely reversed the previous week’s advance on the US-China trade deal.

Although as of now it’s still above the EMA, it really is up to the next bar to determine if this entire move above the EMA on the weekly is a failed breakout or a breakout pullback retest. It could also go under the EMA on some selling but unable to breakdown further, resulting in a trading range.

To conclude, I would say price wise it is more neutral with a slight bearish bias where price could still go down on Tuesday when market reopens or some time next week.

Again, the sign I would be most looking for is some kind of bearish selling climax, which usually only comes once some critical level gets broken. Then I will be looking for signs of that break down failing to look to get involved on the bounce.

However, if price appears to be breaking down further, especially if on the weekly it starts to look more and more like a failed breakout is setting up, I will update my bias accordingly. But so far, at least on the weekly, it is hard to say which case it is.

The Ephemeral Tourist

May 25. 2025 @ 12:10am CST

Edit:

This morning I came upon a piece done by David Woo, a macro guy who is apparently much more bearish, saying that the next 6 weeks will be worse than the weeks following 4/2.

His argument is that now that the administration’s tax bill is almost done, it will turn its attention back to the trade tariff side of things, which we did see on Friday early in the morning as he touted about tariffs on EU and Apple if they don’t comply.

This is indeed a valid risk.

Two weeks ago when the US-China trade deal was announced and even before that when the 90-day pause was announced, the consensus was probably that the administration likely won’t be going through with any meaningful tariffs and eventually the “Trump put” will be in place.

Now that the EU and Apple tariffs are being floating about again, which is raising some concern whether he will follow through with his tariff plan. Remember, even the US-China trade deal was essentially a 90-day pause of the additional tariffs, but not a concrete elimination of such tariffs.

It is really just kicking the can down the road. So if the negotiations aren’t progressing as expected, we could well see more anxiety come back in the market.

Regarding EU, it’s also true that the administration might try harder to squeeze the partner to get more benefits out of the relationship, while the EU likely won’t like that and the trade deal outcome might turn out to be worse than expected. Similar story with Apple, as they appear to be stuck between a rock and a hard place.

One more thing on the chart side is that price is currently right around the gap up low. If it pokes down and loses the Friday low price could be shooting for at least a gap fill to about 5700.

In short, this edit is adding a more cautionary tone to the outlook and we could be in for a bumpier ride than simply just a retest of EMA on the daily and go.

The Ephemeral Tourist

May 25. 2025 @ 12:02pm CST