This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

During the weekend and on Monday when cash market closed, a few things happened that impacted markets, marking some notable shifts.

First is the administration announcing on Sunday that the proposed tariffs on EU starting 6/1 will be delayed until 7/9, after having a “very nice call” with EU chief that the EU will need more time but will move quickly to reach a trade deal.

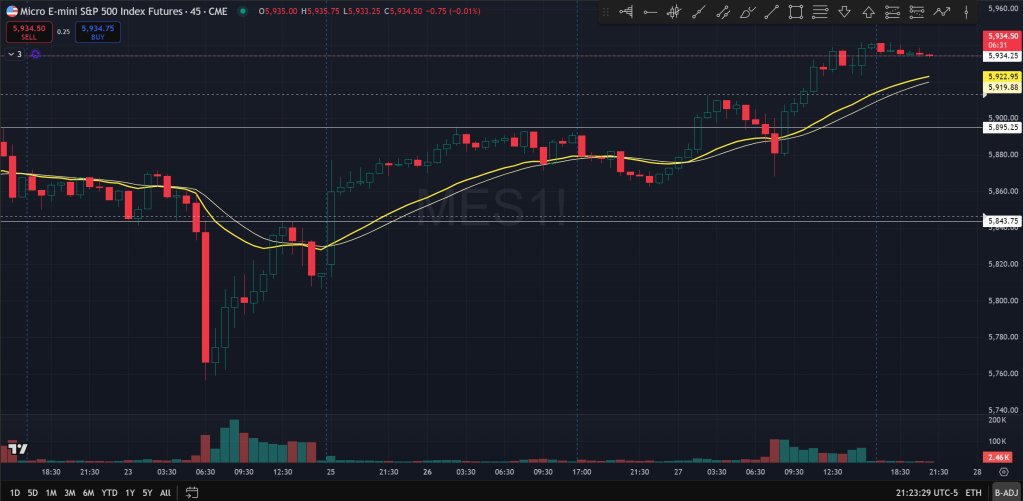

This apparently marks a significant shift from the announcement just 2 days prior which took the market down on Friday. Understandably, markets rallied on the news at the Sunday overnight futures open, retracing all losses from Friday’s sell-off.

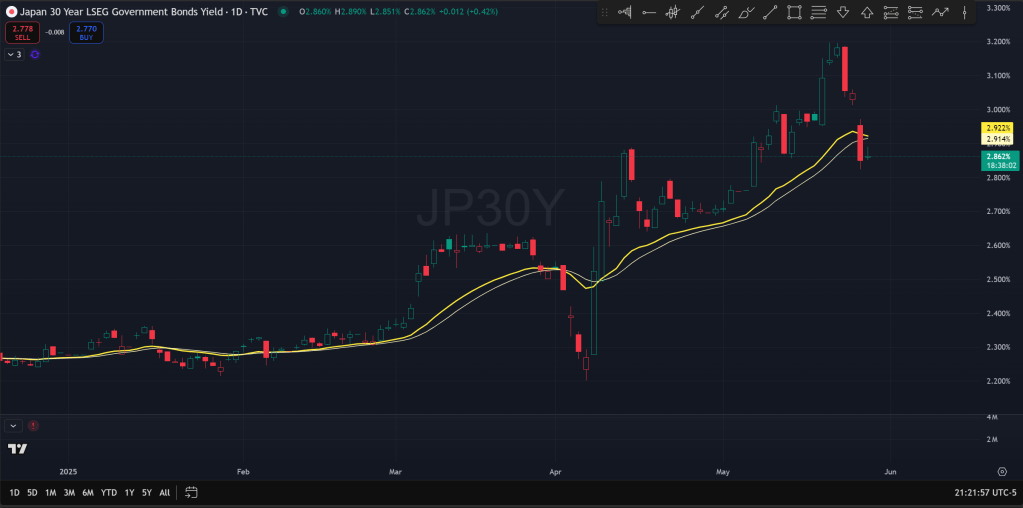

The next came early this morning as Japan Ministry of Finance announced consideration for tweaking the treasury bond auction composition for the fiscal year, which could cut its super long bond issuance, essentially alleviating some upward pressure on the long end yield.

Global debt markets rallied on this signal with JP 30 year yield dropping 12bps and at a low 20bps. US long end yields also dropped, though not as dramatic, down about 7 or 8bps.

The way I see it is that so far at least temporarily, the market is getting a relief on 2 of the most pressing issues. US corporate profits are holding strong with NVDA being the only one major that’s outstanding, due to report tomorrow after close. Jobless claims and unemployment also looks to be in check. Conference board consumer sentiments also came in much higher than expected, likely buoyed by the recent head-spinning rebound from the panic low.

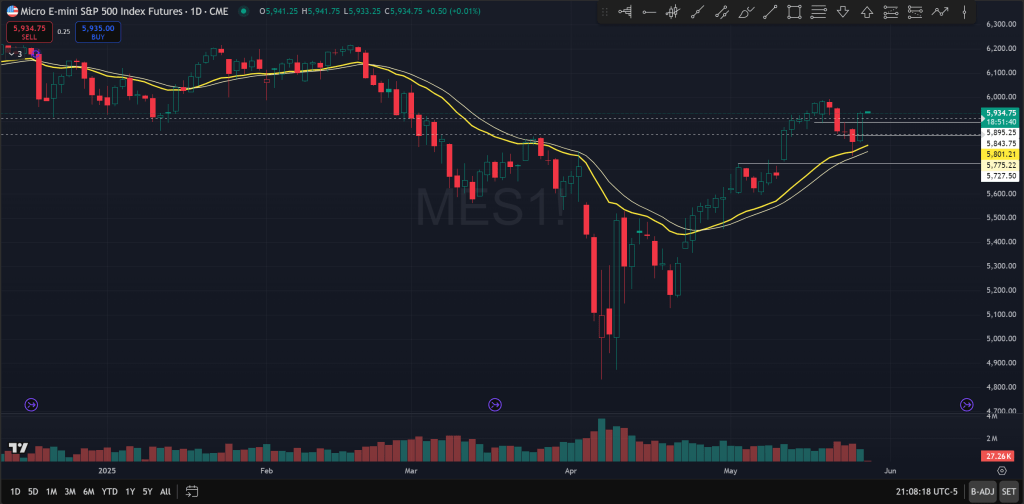

Zooming in back to the SP500 futures to the ETH chart since Friday. One can see that price is showing significant strength with buyers fully in control of the action. Attempts to breakdown into sell-off on Friday was met with strong buying during the day, while Sunday overnight open officially reclaimed the EMA. Price has been riding the EMA since then with dips getting consistently bought.

On the daily chart, one can see that price has appeared to formed a successful pullback retest of the EMA with a bull reversal bar on Friday and a large bull trend bar made today (including weekend and yesterday half day session) that closed on its high.

Currently, there is not a clear bear case until today’s bull trend bar gets fully reversed, and ideally with price under EMA. Price could test higher to 6000 but fail to continue higher and potentially forming a double top, but we will see that when it happens. Essentially, I see price at least visiting 6000 SPX/ES level in the short term likely this week and we will reevaluate next steps once that happens or not.

The Ephemeral Tourist

May 27. 2025 @ 9:31pm CST