This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

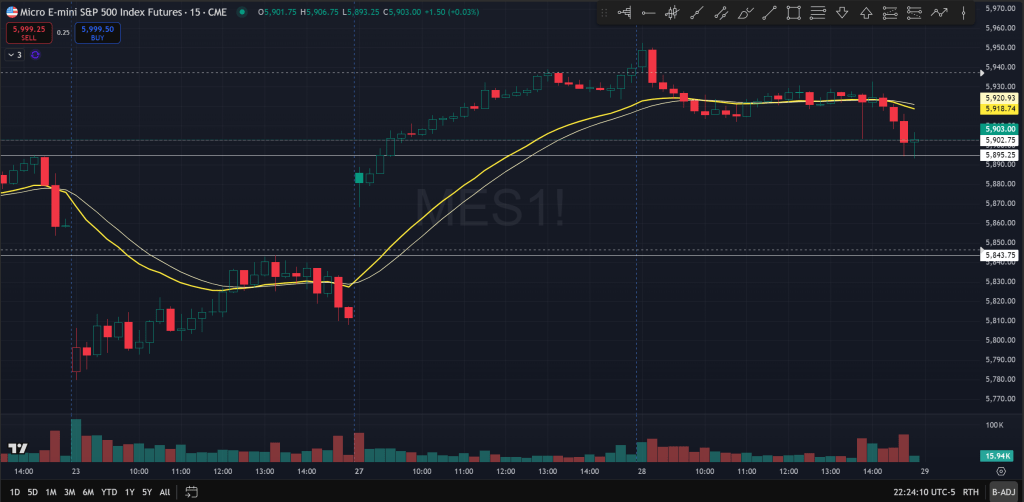

Today during the day it was relatively quiet with the day ending as a trading range day during the regular trading hours. There was notable selling pressure soon after cash open and in the afternoon at around 13:50 and after 14:30.

The 13:50 selling could be from the news that the administration will impose a restriction on sale of chip design software, stoking some fear that this might not bode well for the NVDA earnings after hours.

There was also a potential technical spin to it as well as price spent most of the day in sideways trading around the EMA and made a lower high right before the selling came in. One can argue that the lower high and the general inability for price to break out higher contributed to some anxiety ahead of NVDA earnings, causing some people to exit long which cascaded.

At 1300 there was also the expected FOMC minutes which said basically what everyone already knew and nobody cared about it.

The main event of the day was the NVDA earnings, which judging by the market’s reaction to it, absolutely blew it out of the water, as price reversed the late day weakness and rallied more than 7% bottom to peak in the afterhours. Price was able to sustain most of the gains in the afterhours too.

This also of course buoyed the equities index.

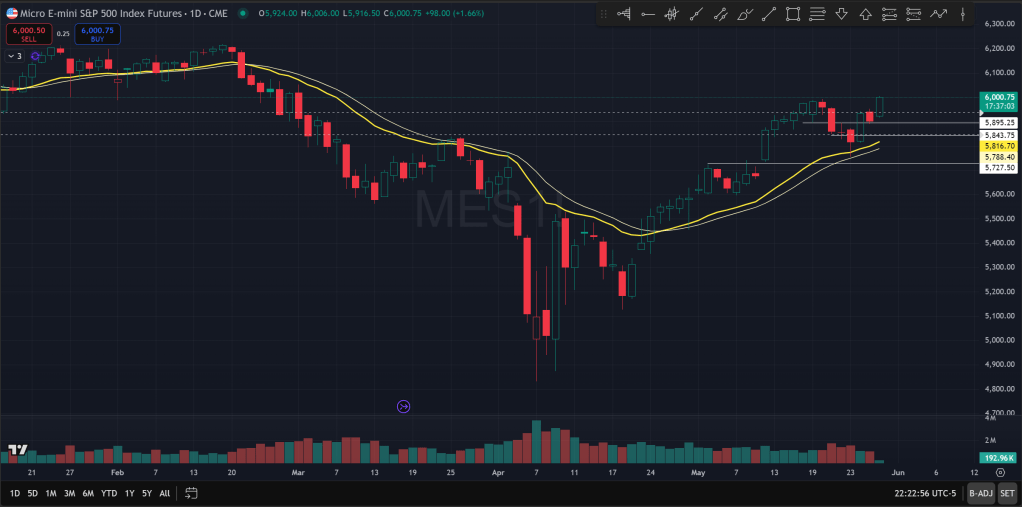

But the more welcome news for the bulls came after the night session got started, as a federal court, the Court of International Trade said the tariff being collected under the International Emergency Economic Powers Act is basically illegal and should be immediately stopped. The administration of course immediately appealed the judgment to the US Court of Appeals.

This apparently marks yet another important shift in the ongoing tariff debacle. Although it’s not yet final and official that the tariffs will certainly be gone, we appear to be heading in that direction.

Equity bulls cheered as ES rallied to 6000 in the overnight trading, while NQ rallied about 2% as of writing.

The bull market appears to be back on track once again after the test down to the EMA on the daily chart made on Friday. We are back at the 6000 level. Like I mentioned in yesterday’s note, there is a potential that price might make a double top here and turn lower again, but with the macro backdrop I view that as less likely. Another thing to be aware of is the month end this week, which might cause some jitteriness especially on Friday. In any case, ATH seems to be back within the view.

The Ephemeral Tourist

May 28. 2025 @ 10:42pm CST