This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Today price disappointed without follow through buying, and even reversed all overnight gains during the day, ending with a doji that closed near its low.

This is concerning as price hit 6000 in the overnight hours. The selling in the early morning hours and the lack of buying interest could mean price is forming a double top.

This came as a federal appeals court granted the WH’s bid to temporarily suspend the international trade courts ruling that the administration must stop collecting tariffs. Basically whatever bullish sentiment participants had overnight yesterday is no longer there and we are back in limbo in terms of the future for tariffs.

Powell also met with Trump today for the first time this year with Trump again calling him too late in lowering rates. Powell and his Fed colleagues, on the other hand, remain committed to setting monetary policy on “careful, objective, and non-political analysis.”

The 7 year treasury note auction was also very good, as people now apparently higher chances of 2 rate cuts by end of this year, as Fed’s Goolsbee said this morning that if big tariffs are avoided, policy rates will be able to come down. This sparked a rally across the curve in treasury futures today.

Back to equities.

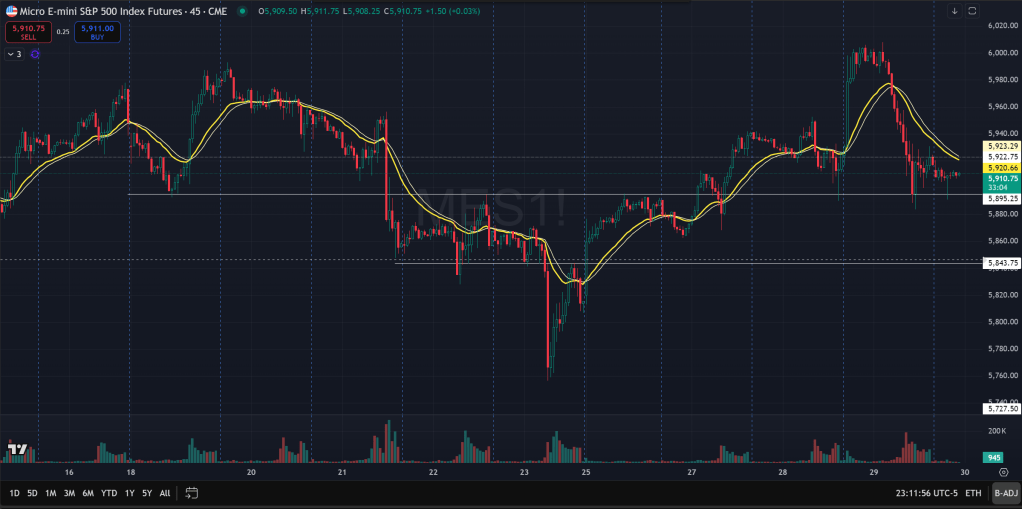

Here on the 45min futures chart showing Globex trading, we can see that price was able to get above 6000 and above May 19 high during overnight trading yesterday, but that rally was met with strong selling early morning at around 3-4am. The US trading hours price was relatively steady and sideways. Price is holding above the 5900 pivot now but below the 21-EMA.

Participants appear still undecided above future direction of the market, as tariff threats and uncertainties still loom while the economy and corporate profits are still quite strong. So any big moves in either direction appears to be inviting participants to trade and pull price back in range.

Apparently, my call yesterday for the all clear was wrong and instead we might be in for some more chop for some time. The chop could even be wide ranged between 5800 and 6000. If price meaningfully broke down below the EMA on the daily, especially if closing below May 23 low of 5750, it will be cause for increasingly more concern.

Tomorrow will likely be critical as it’s the monthly close and will also determine if today’s bearish doji is a valid concern or not. If we close below today’s low, it would be a strong warning sign of lower auction, at least towards low of May 23. Otherwise, price likely will still be able to trend higher from here.

The Ephemeral Tourist

May 29. 2025 @ 11:22pm CST