This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

I was at a work retreat over the weekend and had a family emergency tonight. I will also be away for a week starting Wednesday for a scheduled trip so likely will be gone for a few more days due to lack of access to computer. So I will be brief and just get something in before I leave.

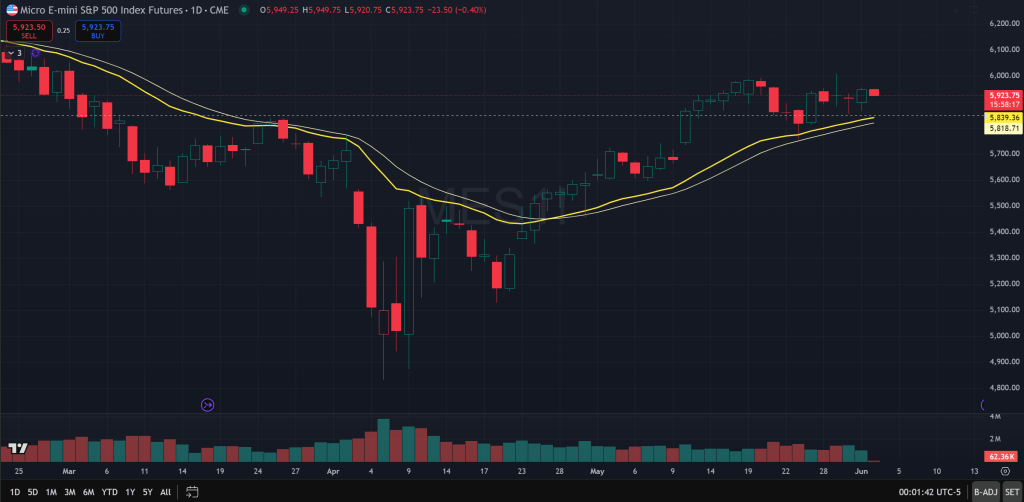

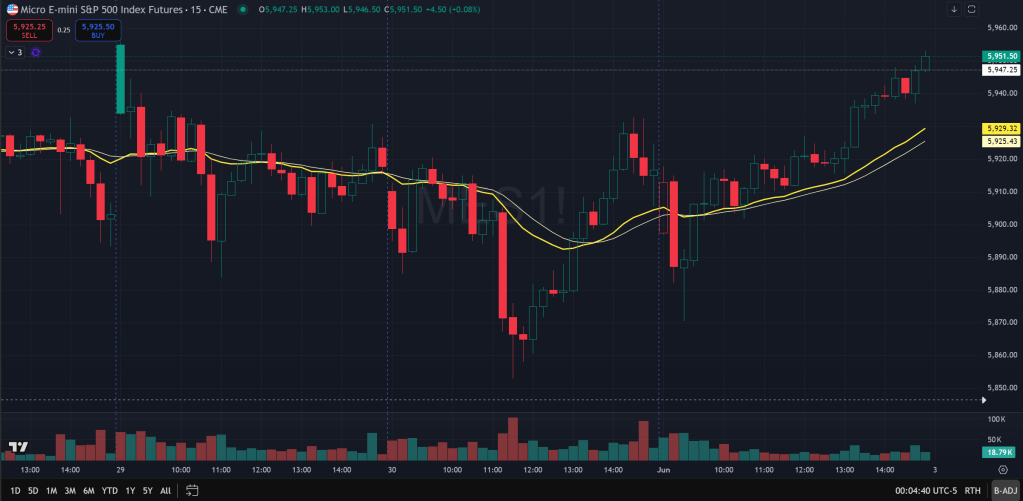

What happened on Friday and today was basically bears tried to break the price action down below the trading range that set up over last week but failed to do so, with strong reversals Friday midday and also today after a overnight gap down and sell-off.

Apparently, bears need to try harder to take price down and with repeated failures like this they are unlikely to be eager to try again very soon without some sort of buy climax, potentially above 6000 or towards ATH.

Note also how today turned out to be a bull trend day that closed on its high, suggesting strong buying interest overwhelming sellers.

6000 level is very close above and at this rate is likely to hit. From there price could stage an upside breakout since price already tested 6000 twice (once in the extended Globex hours). There is a possibility that this all is a bull trap and that the bull breakout above 6000 will fail but we have to let price action reveal that once we get there.

If price is able to breakout of 6000 and hold we likely head towards ATH at 6200-6300s. The macro backdrop is still uncertain for sure, with signs of weakening and the treasury yields and budget deficit and tariffs.

But honestly I don’t have the capacity to conduct a macro research that gives me enough confidence that I’m able to beat the institutions with all their research acumen. I will just try to read price as it shows what all participants agree to be the most reflecting of the current situations.

The Ephemeral Tourist

June 3. 2025 @ 12:13am CST