This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Not much has happened price-wise since I left the blog on 6/4. We had a few econ data points and had a fair share of geopolitical threats in the middle east.

Nonfarm payroll was higher than expected while later CPI and PPI was shown to be not as hot as expected. This is in general good news as the labor market appears to be still holding strong while the disinflation trend allows the Fed to potentially cut sooner or more this year. In fact, the 10 year US treasury yield has dropped about 20bps from the late May peak.

Though jobless claims are flashing some kind of warning as both the initial claims and continuing claims have been trending higher over the past few weeks, and could foreshadow potential weakness in the labor market and thus the economy.

On the geopol front, Israel and Iran have been trading attacks with each other. Friday overnight session saw some pretty steep selling and quick substantial rallies in safe haven assets such as gold, while crude oil was the star of the show as Iran is a major producer of oil, and the attacks could damage supply of the oil.

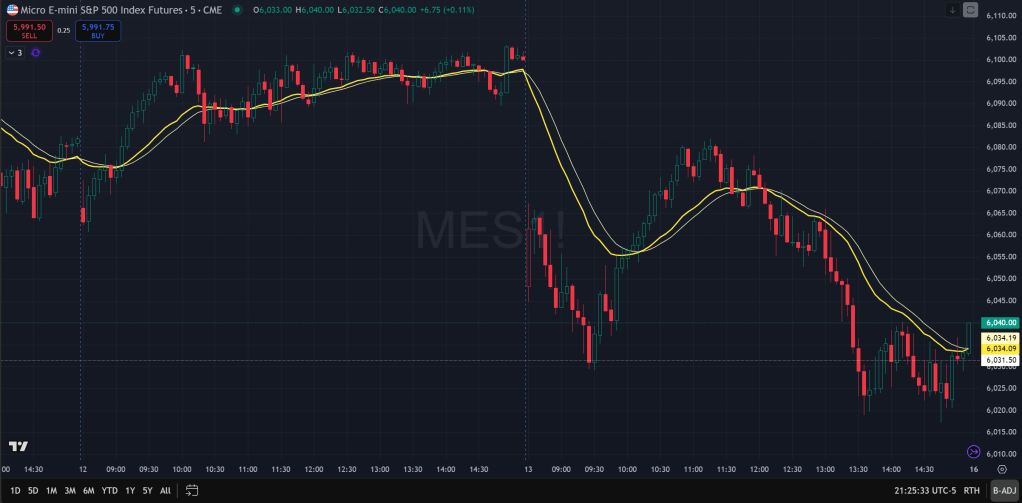

Back to the US equities price action. One can see that price is getting narrower and forming a wedge. Price made a few dojis with tiny ranges during the week and was having trouble getting above prior high made on May 20th.

On Friday, price made a sell-off attempt with the geopolitical event as catalyst, but the gap open did not progress far below and was met with buyers about 1 hour into the trading session. Price stalled around noon and made another attempt lower, closing near lows but could be setting up a failed breakdown double bottom with the earlier low.

In general, the daily chart is showing some signs of topping out. However, price is currently still holding above the EMA and in fact in the overnight session that began at 5pm CST today, price bounced about 1%, showing that buyers are willing to get involved at around EMA.

Despite the rally just now, I’d still be a bit more cautious here as price could easily disappoint and trap early movers on seemingly perfect pullback reversal set-ups. I’d be more willing to long if price is able to hold a bull trend bar by the end of the regular trading session on Monday – the landscape could change drastically when US trading session begins. Right now on this bounce, I’d actually be a bit more interested in a short, for price to potentially test the EMA again on the open.

The Ephemeral Tourist

June 15. 2025 @ 9:43pm CST