This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

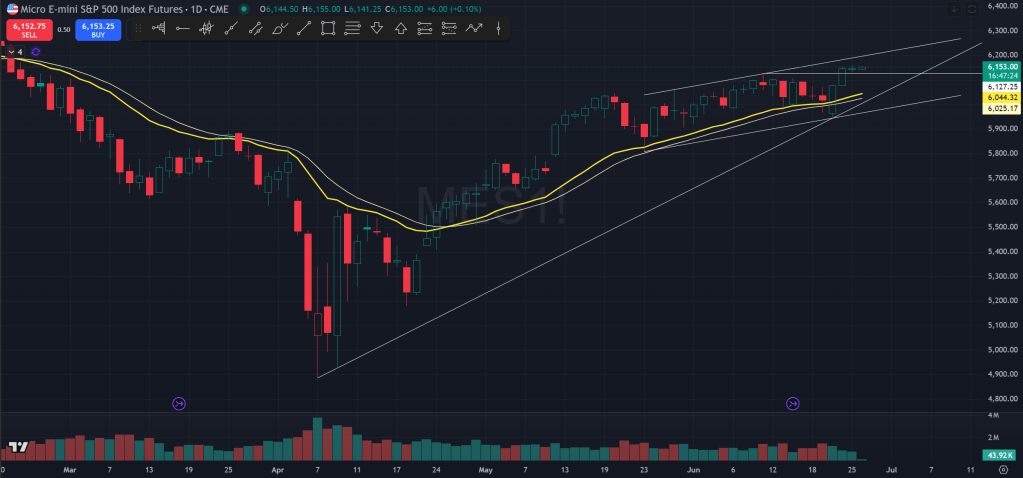

Apparently, my guess at the end of the last post turned out to be incorrect and participants decided to buy the dip below and around the 21 EMA on the daily on Monday. The move was further confirmed by another follow-up bullish trend bar on Tuesday.

Today, price chopped around but notice how despite unable to rally, price did not break down and closely traded around the EMA during the day, and was able to flip back above it by the end. Down moves are routinely cut short by dip buying and overall it was just chop.

So this indicates that the big boys aren’t really interested in selling here. They aren’t too interested in buying too, as one can see on the low and diminishing volume over the past few days. This low interest in trading could be a function of the summer lull, where people go on vacations and stay relatively inactive.

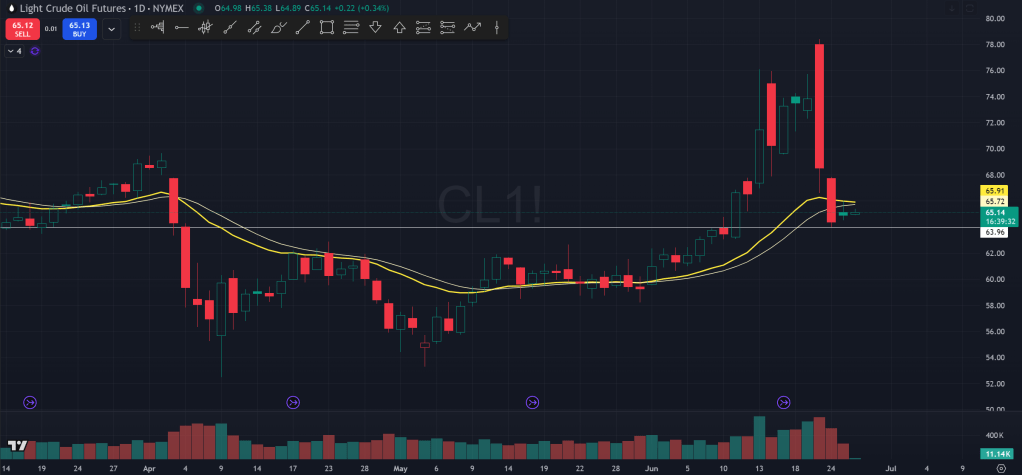

What happened on Monday was basically a clearing of the geopolitical threats. Iran retaliated but it was only in a symbolic manner with a “scripted” attack. And then they announced a cease fire. The highlight of the story on Monday was just how absolutely fked crude oil was.

On Tuesday, it was Powell’s semi-annual testimony during which he articulated a possibility of resuming rate cuts sooner rather than later, if inflation keeps to be in check. This is music to the market’s ears and risk assets got lifted while yields and the dollar both dropped.

So what does this all mean? Well, I’ve exited my short term put protection on Tuesday seeing the market’s unwillingness to drop. If participants don’t want to own stocks they would’ve used Monday or even Tuesday as an opportunity to de-risk. Yet even today without any catalyst, they just held onto the positions and not selling. This tells me that price is biased to go higher and try for the ATH (NQ already did that on Tuesday, but ES not yet). The low volume is also not alerting of a climax high yet.

Could I be wrong? Certainly. The market price movement is never determined because if it is so obvious it will go higher or lower, it would get there immediately as no one will be willing to trade in the opposite direction. Trades happen because participants have differing views and reasonings on different timeframes. So you can always find reasons to justify a move, especially in hindsight.

But this does not mean understanding why the market did what it did in hindsight presents no value. For example, now we know the participants are concerned about the following list of items, from the greatest importance to the least (according to me):

- Potential rate cut resumption, July or September

- Tariffs, 7/9 deadline? TACO?

- Big beautiful bill and spending and inflation

- Labor market and economy and AI

- Geopolitical risk

But again, what I think is totally irrelevant, simply because I have no impact in the market. It is the institutions and big traders with millions that move the market. What matters is how they think about the market. So far I’d say they are feeling pretty good about the market outlook.

Can this market go down? Sure. But it will need some sort of *unexpected* risk event. What that might be? We don’t know. It might be one of the items from the list, for example the labor market suddenly showing cracks. Or it might be something totally unexpected, like earthquake off the shores of Japan.

Either way, the big traders will react and give tells on what they think by how they trade, at least for the known unknowns. For the unknown unknowns, well, they are on the hook same way as you and I.

To recap, I was wrong on Sunday, at least in the short term, as we appear to be making a decent run for the ATH. But I still stand by my *long term* assessment of the market, and how it might be susceptible to more and more *unknown unknowns* in the future.

Although there is also a counter argument here that if the dollar is really losing its value, wouldn’t you want to convert that into shares of some of the most profitable companies in the world? So what this might mean in totality is perhaps we will get more sudden dips, but those dips will continue to be buyable.

The Ephemeral Tourist

June 25. 2025 @ 11:40pm CST