This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

It’s been a few weeks since I last wrote. There are several factors for my hiatus but I will not delve into the reasoning today. I’d rather put that in writing some other time when I feel like it.

Let’s just say that being lazy while also constantly questioning the meaning of things is not a good recipe for consistent productivity but I do realize that writing things down can help me greatly in terms of memorizing things and clearing up logic. I’ll just briefly write up an update as I see fit.

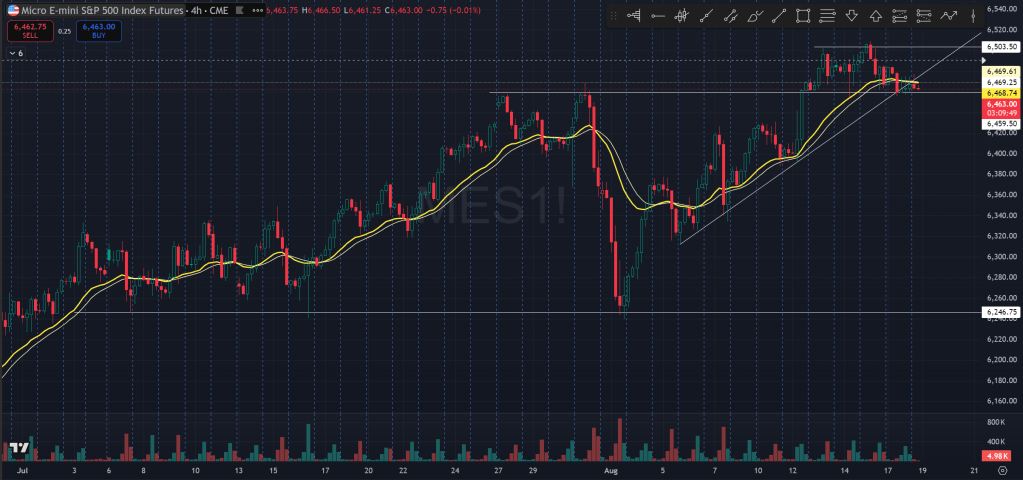

In all honesty, the market has migrated into a state of balance and chop for the past month and a half. We’ve had a dizzying rally since April low and was able to push higher above the Feb high making new ATHs.

At the same time, the payroll numbers came in as a huge disappointment with 90% downward revision for previous month numbers, prompting the end of the former BLS chief’s career. This also coincided the rather significant sell-off on 7/31 seen on the chart.

CPI last week was not as hot as people feared, but PPI was higher than expected. Rate cut expectation currently sits at 84% for the September meeting, which at a point was nearly fully priced in after CPI. Fed’s Powell was repeatedly bashed by the administration while several potential candidates to the hot seat expressed willingness to cut rates rather aggressively.

Fed’s annual retreat to the Jackson Hole is occurring this week with a scheduled press conference on Friday having potential to bring about volatility and break the tie. Wall Street appears to be fearing the unexpected hawkishness that Powell might exude but he might not have too much of a say in the matter anyway.

Retail giants are poised to report earnings this week too. HD reports tomorrow morning while TGT on Wed and WMT on Thurs. This likely will be important as it can show exactly how well the consumers are holding on and how much tariff costs (including projected tariffs) are currently being bore by the retailers that will potentially be passed on to the customers later or if they can’t pass it on hurt their margins.

On the political front, the big story is about Ukraine and Russia deal. So far it seems to be going well. Gold came down from recent peaks after information of gold bar tariffs and subsequent debunk of said information. Yeah. Lots of misinformation. That said, gold has been in an extended period of balance and wide range chop since basically April and the peace deal prospect has not been able to severely cripple gold just yet. Something to consider.

Today everything traded with thin volume. Apparently, participants are refraining from large bets ahead of some potentially important information this week. Could we see a break of tie by the end of this week? If so, my bias would be for a correction in the US equities. For gold, it’s less clear given the tug of war between tariff and inflation and rate cut prospects vs. a potential de-escalation in geopolitics. I’m also not a professional in terms of macro so take it with a huge grain of salt.

The Ephemeral Tourist

August 18th. 2025 @ 10:11pm CST