This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

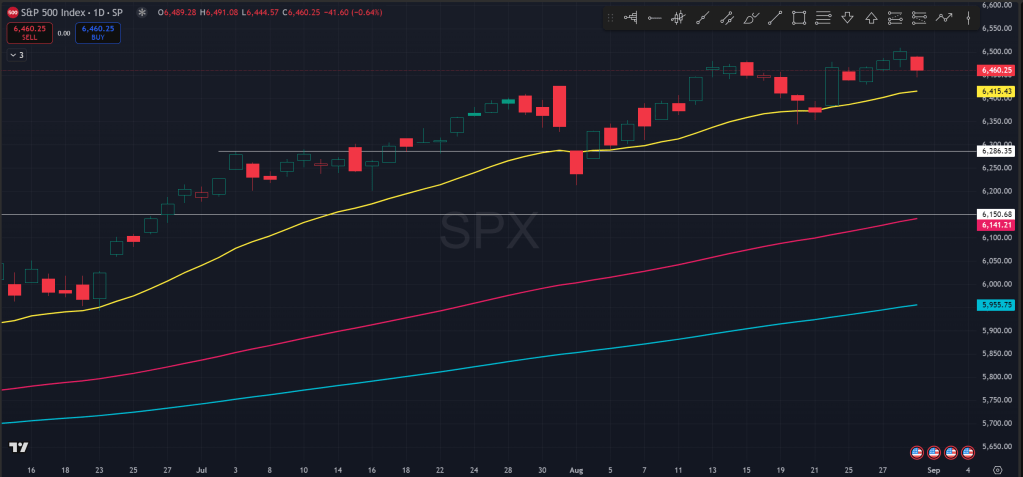

Since my last update 2 weeks ago, SPX has been grinding higher along the 21EMA on the daily chart, but with notably smaller margins above the EMA. This suggests potential weakness as price has made consecutive bullish trend bars on the monthly chart ever since the Apr sell off and bounce.

Over the past 2 weeks, the most important story to me was Powell’s Jackson Hole concession and the Trump’s firing of the governor Lisa Cook.

During the annual Fed retreat, Powell signaled a more dovish stance as the focus shifted more towards the labor market. He said that “while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers”. He also said that GDP growth has slowed in H1, so in aggregate there is now higher risk towards that labor side of the dual mandate.

Regarding inflation, he posited a case where the inflation due to proposed and enacted tariffs being a one-time shift, instead of resulting in wage-price spiral due to the general slowness of the labor market, while inflation expectations remain well anchored.

So putting it all together, “with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” Risk assets cheered as they viewed a September cut as almost set in stone.

And then there was Trump’s firing of Lisa Cook, due to alleged mortgage frauds back in 2021. There is now a legal challenge by Cook regarding Trump’s dismissal and a hearing was made on Friday but the results would likely be known over the next week.

This incident likely further casted doubts on the potential vanishing of the Fed’s independence, and also likely upped the inflation expectation.

One symptom of this is the yield curve. One can see that the short yields (belly) all dropped from Aug 15th to 22nd and to today but long term yields remained much more steady and even rose slightly from the 22nd. This general dynamic is much more visible when you compare today with a year ago right before Fed’s first 50bps cut in this cycle.

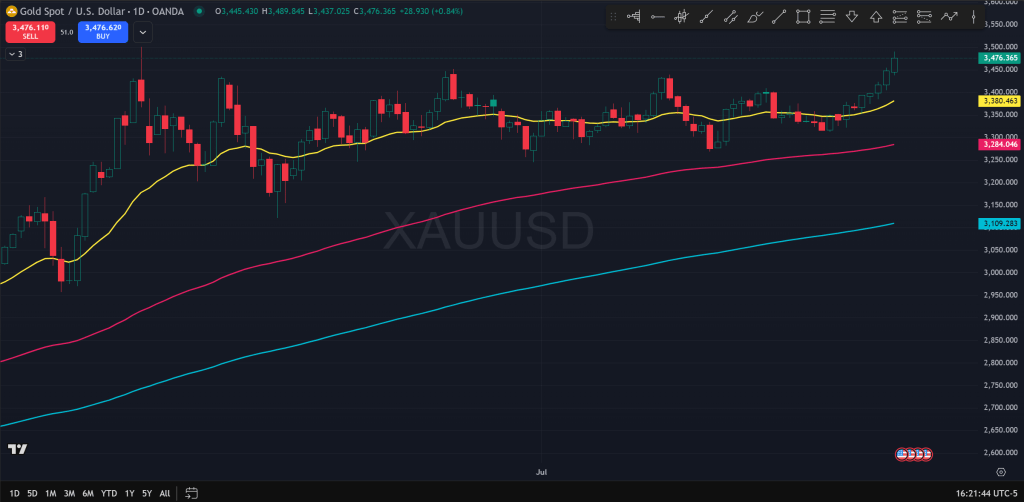

Also evident is the gold which started to move higher since Aug 22nd towards the upper bound of the monthslong consolidation range.

Coming up next week, the key data point will be the NFP which I’ve seen people calling for additional surprise revision downs for previous months’ numbers. They suggest that if the NFP was to indeed get another downward revision similar to that seen in Aug, this could open the door for 50bps cut for the Sep meeting again. Note also that on Sep 9th there will be QCEW along with the employment stats benchmarking which is used to align yearly stats. This could expose any overestimation over the past year due to the birth-death model.

To conclude, I see the Fed’s so-called or perceived independence continue to be challenged and for inflation expectation to slowly creep up. This could suppress long term bond appreciation even if the Fed lowers the Fed funds rate which they can control. Gold and other inflation protection assets could continue to appreciate as well as stocks, but stocks face the additional threats of labor market weakening or potential economy slowing down, which could bring brief episodes of growth scares.

However, my assessment is that any dips will be buyable as holding cash will likely be unattractive as opposed to holding stocks to some of the world’s most profitable companies with diverse sources of income that can weather uncertainties much better.

The Ephemeral Tourist

September 1st. 2025 @ 4:33pm CST