This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

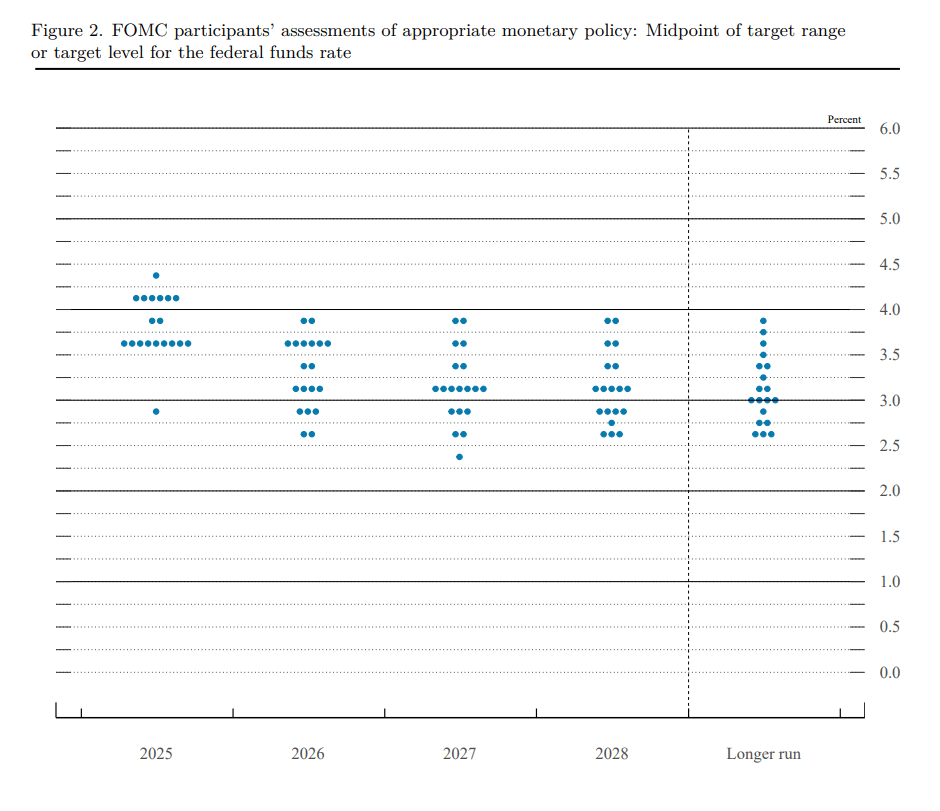

The Fed has cut 25bps as expected on 9/17 and the median projection from participants points to a 50bps further cut for the remainder of 2025.

The verbiage used by Fed chair Powell is that this is more of a risk management cut as the Fed now apparently deems the weakening labor market higher risk than potential inflation from tariff, even when inflation is still running above trend. They instead view the inflation from tariff more likely to be one time only shift.

What this likely means to me is that the Fed is moving or has moved the inflation goalpost and even if inflation might not be back at 2% for extended time, they are still willing to cut rates for the sake of the labor market.

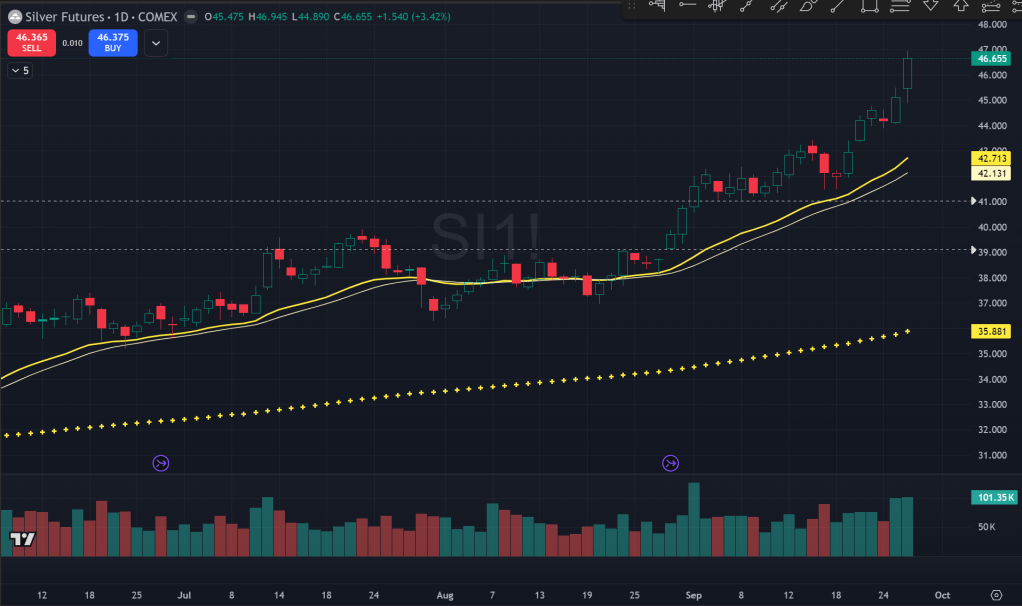

Markets appear to be seeing this and precious metal is getting a boost making consecutive new all time highs. Silver has overtaken gold as the star of the show last week higher by more than 8% while gold after rallying so much has taken somewhat of a backseat.

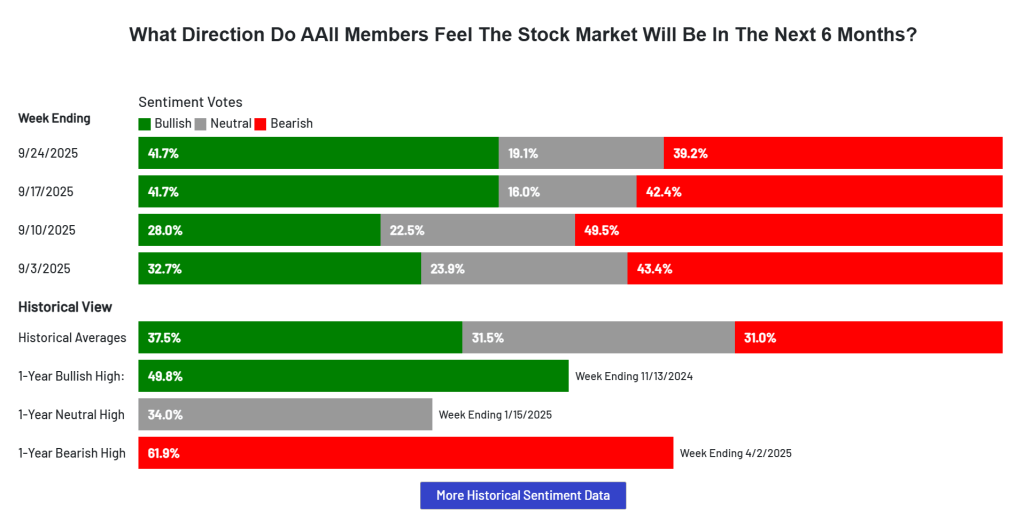

However, there was something that gave me pause regarding equities last week. Before the FOMC meeting, retail sentiment has been generally bearish and price was having somewhat of a hard time moving higher in most of August and early September.

This changed quite dramatically in the week ending 9/17 as bullish sentiment got a significant boost while bearish sentiment dropped. This raised some alarm bells in my head that we could be seeing the hold-outs throwing the towels and cutting the losing short and flipping long, which could be marking at least a short term top.

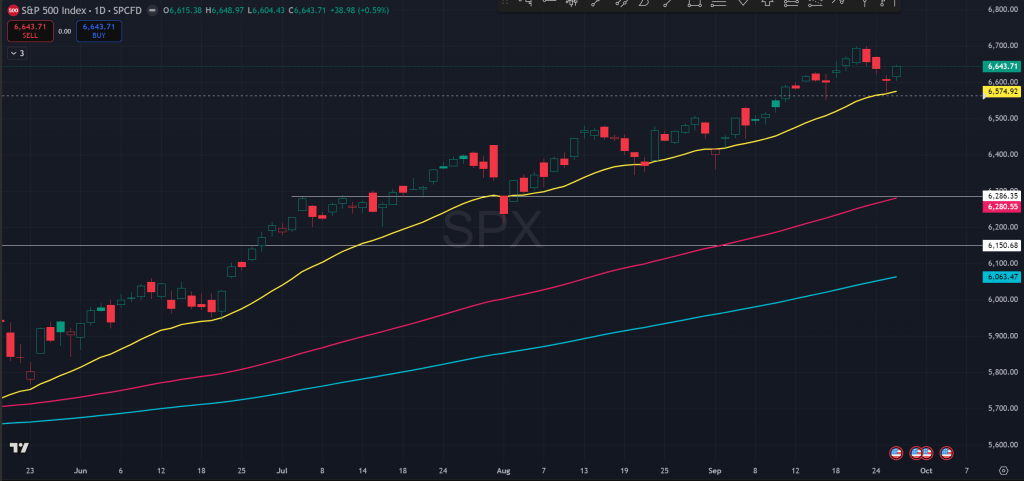

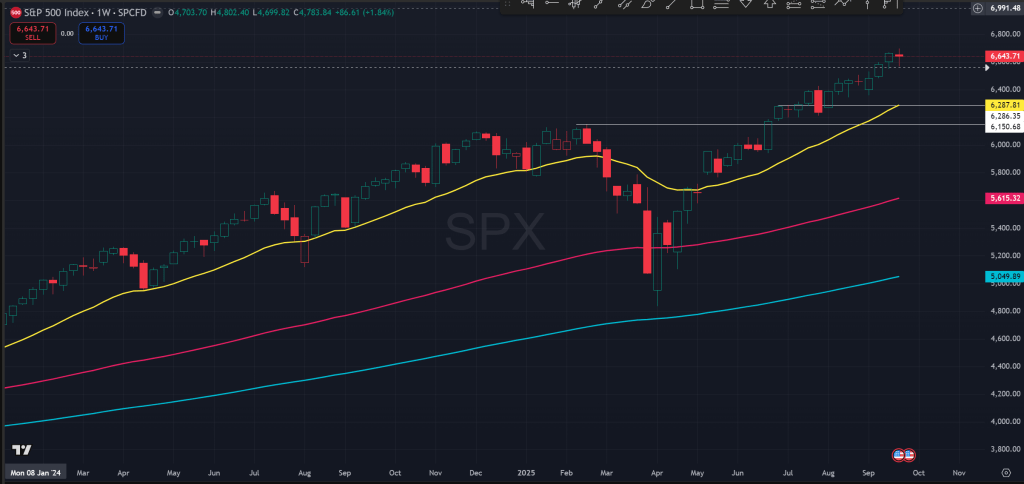

This materialized this week as 3 days of selling that took the SPX back to the 21 EMA on the daily on Thursday. But then price promptly rallied on Friday while sentiment ending on 9/24 remained bullish with further decrease in bearish callers. This could instead mark a more sustained shift in sentiment therefore a more sustained bullish move.

It will be interesting to see if price is able to build on the momentum that showed up on Friday to resume the bull trend, or if this will quickly fail back below the EMA. Currently, my assessment is price could continue higher.

Price hasn’t touched the 21 EMA on the weekly for some time now which is something that’s giving me some pause, but at the same time, there is no bad news and inflation so far is well-behaved while the economy and labor market is still in good shape, at least for now.

Within equity land, recently there was a wave of rally for nuclear stocks, as the US and UK signed some deals to build nuclear power again. There was also another wave regarding memory storage for AI.

On the geopolitics front, there was some escalation this week regarding Russia/Ukraine and NATO, as NATO has told Russia that if will down jets if incursion into NATO airspace. Simultaneously, Trump has pulled an about-face saying Ukraine can reclaim all its lost land, contrasting his views in the beginning of the year. This likely exerted additional pressure for precious metal to move higher. Crude oil also moved higher as Russia oil refining infra suffered drone attacks from Ukraine.

The Ephemeral Tourist

September 27th. 2025 @ 9:46pm CST