This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

On Friday 10/10, we had a huge sell-off with a magnitude that was not seen since Apr of this year. The trigger was a truth tweet at around 10am CT by the president over China’s rare earth export restrictions with the president vowing retaliation in the form of higher tariffs against China imports.

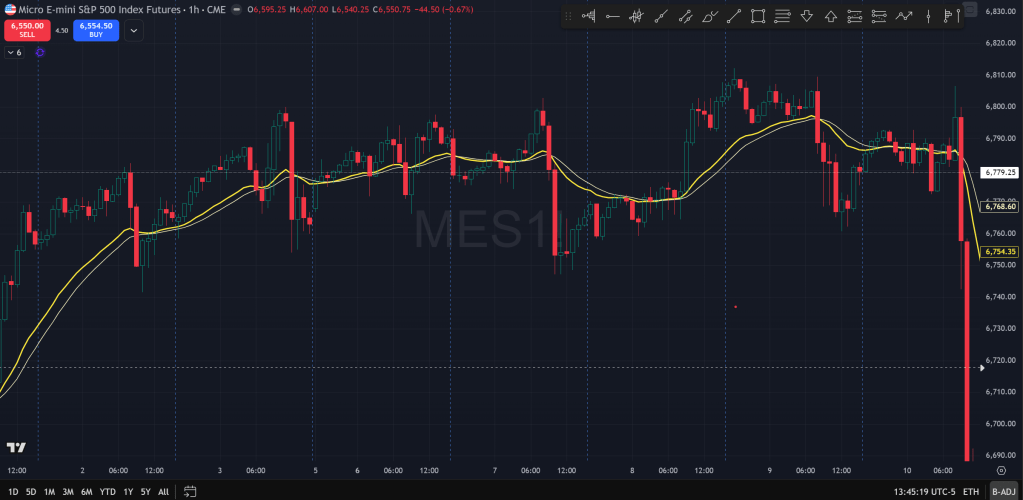

This at least is the trigger on the surface. However, when looking at this week’s price action in equity land, one can see that price already started to face some resistance since late last week, with last Friday 10/3 a1fternoon seeing some selling and curiously on Monday 10/6 price did not overtake the high.

This evolved into a more significant sell-off on Tuesday that almost looked to be breaking the balance before Wednesday it climbed again to make a new ATH. If on Thursday we continued higher, this would be quite constructive and could mean that we were continuing higher. Instead, what we saw was a push higher followed by another sell-off back to the low of the balance area.

This in itself is already quite a strong warning sign that we could be in for turbulence. It’s also pretty clear if you zoom out and see how price was basing just above the 9/23 high for this week. So basically, with Thursday’s action it is already showing strong signs of potential top forming.

Of course, no one could’ve foreseen the truth tweet and the ensuing bloodshed in the markets on Friday. It was surprising to me the magnitude of the sell-off, but ultimately one can justify it by saying that there was resonance among late bulls cutting losses and early bulls taking profits.

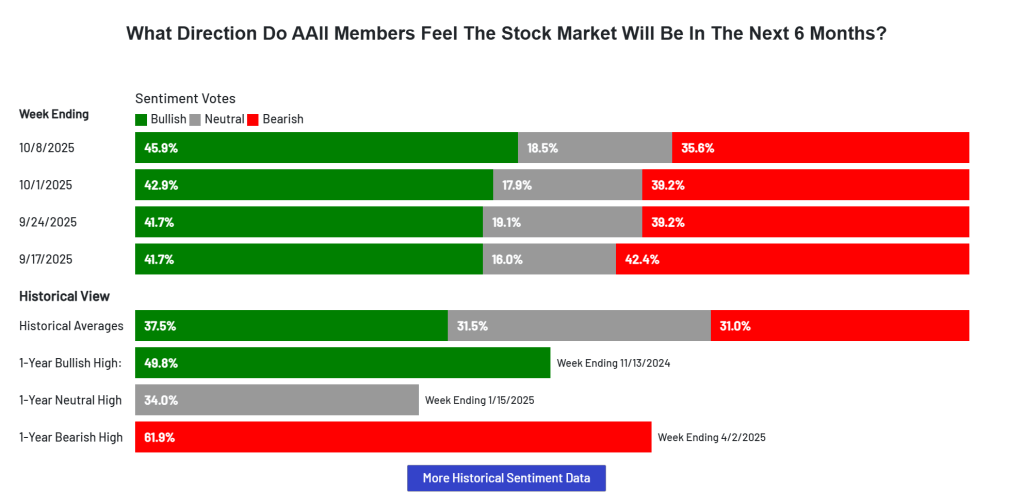

As I have been saying for some time now, retail crowd has been getting increasingly bullish with the flip happening back in 9/17 on the Fed day. This has been a point of caution for me and sure enough the bullish sentiment reached a peak on 10/8 just before the huge sell-off. Coincidence?

Now back to the tweet. The president is threatening to impose a 100% tariff against China imports starting 11/1, which is several weeks away and is clearly opening the doors for negotiations.

Why I think TACO is on deck is because this hurts the US more than it does China. The US economy has been frankly propped up by the huge AI investments that buoyed the stock markets and more or less supported high income spending through wealth effects.

If the US and China really escalates on this route, the rare earth sanction can at least in the short term put a huge dent on that AI side of the balance and with it take the entire economy. I see no reason for the president to be doing such a thing, especially before next year’s midterm and 250 year anniversary.

In fact, as I’m writing this post, if you look on truth social, you would see a post from the president almost conveying this idea. We’ll see what happens tomorrow and next week broadly.

To reiterate, I see this Friday sell-off as just a news based external shock that happened to trigger a lot of selling both from early bulls and late bulls (retail crowd) and perhaps some forced selling as well.

This is likely a short term shock that will rather quickly dissipate as I view both sides will be back on the table since that’s the better decision for either of them. I could of course be wrong in this but so far I think it tracks and taco is on deck.

The Ephemeral Tourist

October 12th. 2025 @ 2:11pm CST