This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Following the bloodbath that was 10/10, equities got a decent rally on the week as TACO was served. However, the damage done to the market and sentiment was no small thing to simply shrug off.

Nothing too major developed this week as the government is still in the shut down with no econ data being released.

There was, however, a notably volatility spike on Thursday following two regional lenders, Western Alliance Bancorp and Zions Bancorp, that reported credit losses from commercial and industrial loans that also included a potential fraud element.

This put people on high alert as just recently there were also incidents of First Brands and Tricolor bankruptcies leaving creditors holding the bag. Jamie Dimon was even warning of ‘more cockroaches’. Evidently, people decided to go risk off as they fear potentially a similar fall-out to the mini banking crisis that happened back in March of 2023.

Personally, I think the circumstances are very different as back in 2023 there was a real liquidity issue and those banks were sitting on huge paper losses from the long bonds they held that dropped in value as the Fed hiked rates in ways not seen in decades. This time around, the loan losses were not impacting the bank’s earnings so much, while at the same time the Fed is cutting rates.

Plus, I continue to think in this way that the president would not in a million years allow an economic crisis to happen under his command, especially not before the midterm and the 250 year anniversary next year. Whether you like him or hate him is besides the point- I personally think he will do whatever is possible to avoid any major economic pain to the public.

Back to this week. Note that essentially what we have this week is just range extension kind of chop where buyers and sellers are currently somewhat in balance. The 10/10 low saw buyers coming in while the broken support of the previous higher balance served as a place where trapped longs likely exited. Additionally, although not on the screenshot here, the volume in the futures stayed elevated throughout the week.

Friday 10/17’s action felt a bit more constructive as the Thursday and overnight banking scare got almost fully retraced. However, like I said in the beginning, the damage done to sentiments might need some more time to get repaired, or it might need to come down to corporate earnings and see if they are still going to keep the party going.

It really is quite simple right now- just watch the 6700 SPX and 6550-6600 SPX. If we break either credibly then we might be moving again.

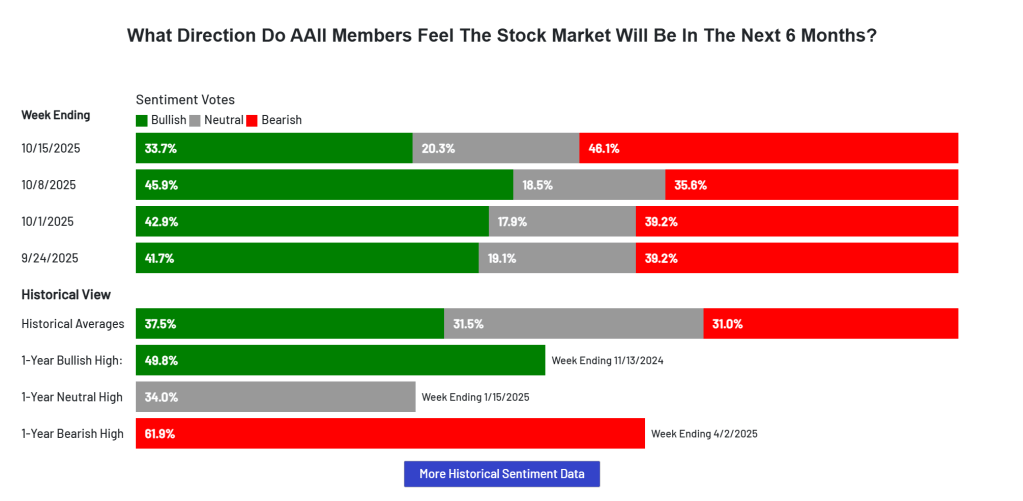

Personally, at least for the coming week, I suspect attempts to go higher might fail as more pain would likely be needed to shake out weak longs before the earnings if they really want to go. This is from my conviction that Trump will not allow things to break down. Some of the retail crowd have already suddenly turned bearish but this might need to go a little bit more to clean out the excess.

I would be remiss not to mention gold and silver this week which potentially had just formed a top at least in the short term with short squeezes that reversed on Friday. I was bullish from about late August but my speculative bets I took off way too early as I completely did not see they could run this much for this long without a significant pullback.

Now I will be watching closely for signs of a potential top to form- if price is unable to get above this week’s high soon then the party might be over, or at least needs to pause and shake some late buyers out.

The Ephemeral Tourist

October 19th. 2025 @ 11:49pm CST