This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

In my last week’s review, I was suspecting that any moves above the chop over the previous week might be fake and that equities might need to head lower before the majority of the heavy weight tech earnings coming in next week.

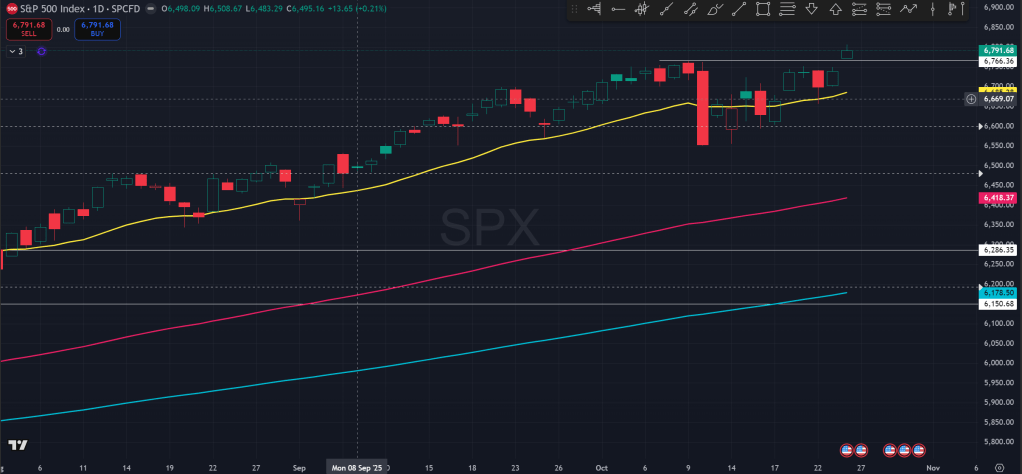

Equities, however, moved higher on Monday and despite a pretty decent and relatively broad-based sell-off on Wednesday, was able to hold above the 21 EMA on the daily and moved higher on Thursday and Friday, even making new ATH on Friday.

This strength is apparently driven by 1. the credit fears that happened back in the previous week was overblown; 2. the trade tensions between the US and China are showing signs of mitigation and could be resolved through negotiations; 3. inflation so far is well anchored and well behaved, green lighting further rate cuts and easing from the Fed.

We also got the earliest of the tech earnings including TSLA, INTC and TXN. NFLX also reported on Wednesday. In fact, the earnings were generally somewhat disappointing with stocks getting hammered after hours except for INTC, which after a rally after earnings gave all gains back in a Friday sell-off.

This could be a warning that prices especially for those tech names that hinge on AI have run a little bit to far and will need to either cool off or go sideways to allow time for earnings to catch up. We will get heavy weight names next week including AAPL, GOOG, META, MSFT, AMZN, etc.

This brings us to the question of should we be trusting this latest rally and attempt to resume the bull trend after a pretty scary but relatively swift and brief pullback. In fact as I’m writing this post, China and US have already came to some agreements and that the 100% tariff that was threated appears to have been taken off the table. Futures have moved higher on the Sunday night open but have since came off highs.

Personally, I continue to think that the current environment should be favorable to stocks.

- Inflation doesn’t appear to be running rampant from tariffs, enabling an accommodative Fed.

- Labor market is showing some signs of cooling in a no-fire no-hire situation but does not appear to be in immediate danger, also prompting the Fed to be ready to step in in case of further weakness.

- Trade tensions appear to be easing or at least are heading in the correct direction. Additionally, there is potential for tariffs to be ruled unlawful.

- The president himself cares about his legacy so he will do whatever it takes to ensure the economy is in a good shape, even if just on the surface, before the midterm and the 250th anniversary.

The only thing that is somewhat hanging is whether big tech earnings can live up to the expectations and their valuations. This is especially concerning given previous reports of kind of circular capital investments between AI companies, and that Open AI being the leader in the industry has apparently been looking to monetize through certain type of “entertainment”, casting doubts on whether all those AI investments can really turn into real profits.

But at the same time, an argument can be made that AI is going to be the next big thing and that whoever gets to come out as the winner will be able to set the industry standards and gain a uniquely powerful position. This works both for enterprises and for countries. This is essentially to say that investments to the AI will not stop, as long as the companies and countries are able to keep up, which for countries can be as simple as raising more debt, so long as not to cause too much inflation.

So what does this mean in aggregate? My view is basically still that in the intermediate to long term, equities look to have more tail winds than head winds.

In the short term though it all hinges on big tech earnings next week. So far price appears to be resolving to the upside on optimism over trade tension easing, but that could rapidly change if earnings disappoint next week. If price indeed ends up falling back into range next week after the breakout this week, then the short term outlook will turn much more precarious.

The Ephemeral Tourist

October 26th. 2025 @ 9:46pm CST