This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Over the last 2 weeks, markets got a reality check regarding the AI spending and investment, as FOMC indicated potential pause or even stop of the rate cutting process that was perhaps thought to be running for much longer. OpenAI calling for government backstop for AI investment certainly did not help sentiments.

There was additional drag on liquidity and sentiments from the government shutdown as funds were not being spent due to not reaching a deal on the budget plan.

Things took a turn late in the week on 11/7, when news started to come out about a potential stop-gap plan that will reopen the government and keep it funded until Jan of next year for most agencies and a few others including USDA for another whole year.

Equities got a jot in the heart on that day and rallied with some follow-up higher moves early this past week.

However, this bounce was met with selling starting Wednesday and on Thursday as the government reopen was final, markets decided to take another move lower. During Friday overnight, it almost hit the intraday low made on 11/7, although markets promptly rallied during the day on Friday soon after cash open, as retail crowds panic sells during the opening period.

Looking at the above day chart, it is seemingly that price is making a top. This is evident in the lower high from 10/29 to 11/12. Additionally, price did not close above the 21 EMA and the 6760 level which was the high right before the 10/10 sell-off. This is inconsistent with strength and shows a general lack of interest to be buying this rather shallow dip here.

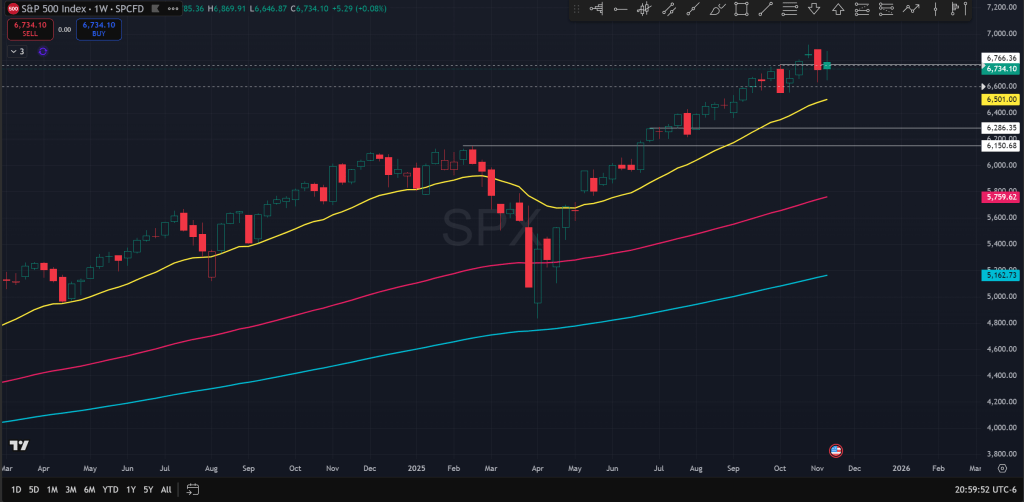

Zooming out to the weekly chart, it is obvious that the dip isn’t really much of a dip at all in the grand scheme of things and price hasn’t even touched the 21EMA on the weekly chart for months now. Looking at this, a potentially strong support would be around 6150, and that is roughly 8.5% down from here, and about 11% down from the peak from late October. This would be a reasonable magnitude for a pullback.

Next week, we will be getting some of the backlogged data including the September NFP that will be released on the morning of 11/20. I have no idea whether it will be good or bad, but markets could be using that as a catalyst to shape whatever narrative that makes most sense.

The Ephemeral Tourist

November 16th. 2025 @ 9:07pm CST