This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Over the past holiday-shortened week, equities experienced a relentless melt-up with thin trading volume. This melt up completely reversed the rather significant sell-off that happened on 11/20, after a touch of the 100EMA on the daily chart for SPX.

Like I said in the previous week’s recap, I personally consider that if price is able to stay and close above the 11/20 high, chances are higher that the pullback is complete and the 11/20 low (which is also 10/10 low) will likely be the lowest we see in the intermediate future (likely for the rest of 2025).

Price actually stayed above that 6770 level from Wednesday through Friday, even as CME having some overnight cooling issue at its main data center, causing trading to be halted for a good 11 hours. There were some concerns that there would be increased volatility Friday morning once the system is back online but eventually Friday was quiet and generally edged higher.

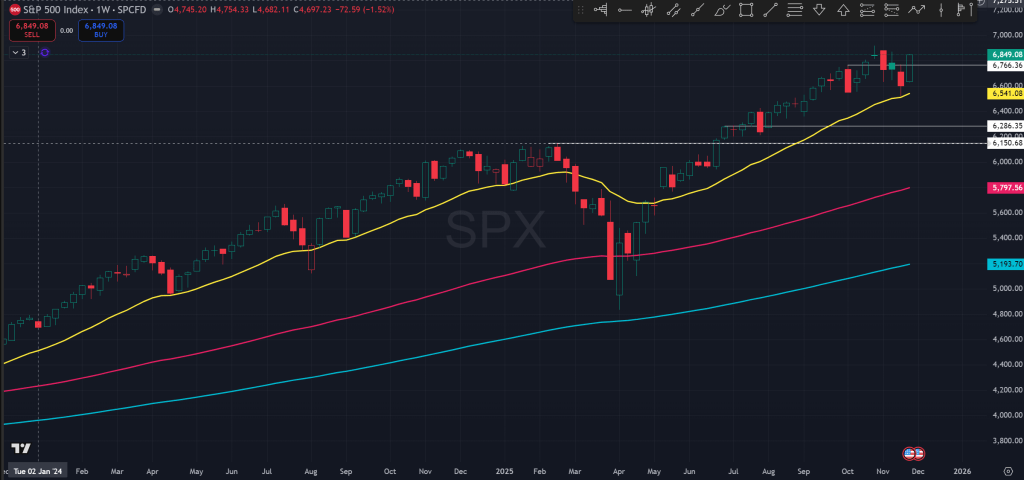

If we zoom out to the weekly chart, we can see that price touched the 21EMA and bounced nicely as dip buyers came in swiftly after the sell-off. The momentum shown this week appears to be somewhat strong so it’s reasonable to see some follow-through buying next week once most people come back from the holiday.

The question is whether we test down a little bit first, seeing that the momentum within the week has dropped during the last days, or do we see first price testing for the prior ATH. The current price level is at about the mid-point of last week’s high and prior ATH, so it would seem equally likely that price reaches either.

Personally, I favor the scenario where price tests down a bit to secure and confirm the reversal of the 11/20 sell-off, then continues higher to test ATH. Then it will be the question of whether ATH gets taken out. If it does, the end of year Santa Rally looks to be on deck to close out this volatile year.

The Ephemeral Tourist

November 30th. 2025 @ 10:59am CST