This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

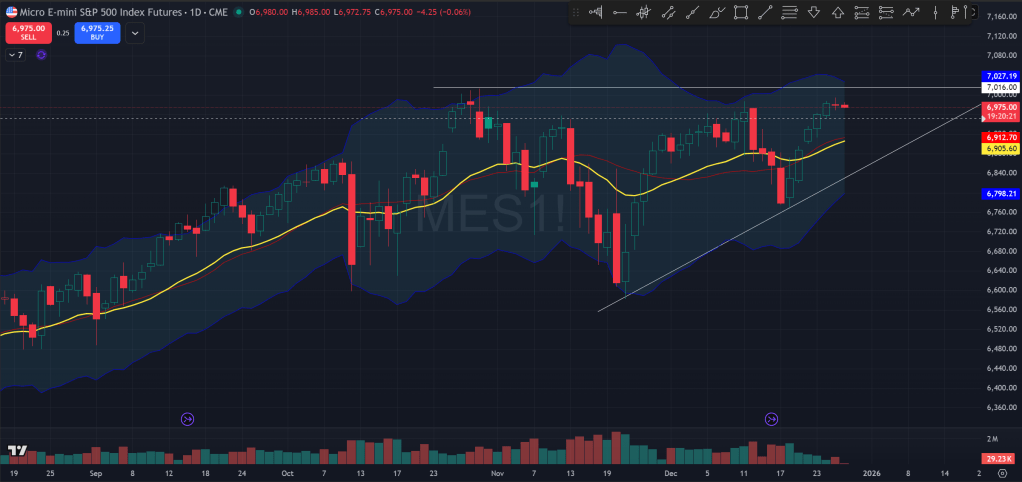

Since my last post on 12/12/25, not a huge ton has happened. On a larger scale, price is still in a range but now appears more and more ready to resolve to go higher.

Over the week of 12/15, price dropped in the first half of week and closed below the 21 EMA on the daily for a few days before rallying back in the latter half to close above the EMA by Friday.

The initial weakness was mostly due to continued negative sentiment in tech stocks following disappointment in AVGO, ORCL in the week prior. NFP also came in slightly higher while unemployment rate also was a bit higher than expected. This could be adding some fear that labor market could be fast weakening while the Fed might not be able to cut as much as hoped. Some rumors about the Fed chief nomination could’ve added to the sour sentiment.

The low happened on Wednesday with the turnaround on Thursday 12/18, after a weaker than expected CPI while weekly jobless claims also cooled. This likely helped instill more hope for a Santa rally, which did happen for the holiday shortened week. A few Fed speaks also helped positive sentiment for a more accommodating Fed in the new year.

In general, not a lot has changed in the grand scheme of things and market has been rather slow with thin volumes, typical of end of year holiday season trading.

Looking at the new year, my base case would be for price to be able to resolve higher. This is due to the fact that we have been in a bull trend, and the Fed is on a loosening quest, while at the same time the AI spending is still going on and could be seeing some more utilization and boost to productivity in the new year. The labor market could be weakening, as the no-fire-no-hire continues on, but I find it hard to imagine that the president would allow any real weakening in the labor market and the economy to happen in the year 2026, so the Fed would be ready to step in with force with any concrete sign of weakness.

In the short term over the next week and the 1st week of 2026, I would not be surprised again to see some sideways action, but any sell-off might be rather short-lived. This is since price has made some rather vicious sell-off, especially in high flying tech land over the week of 12/15.

In areas outside of equities though, precious metal has been absolutely bonkers over the 2nd half of 2025 and especially recently. This likely started from the expression of the bet that the Fed will be forced to continue cutting even when inflation is not completely tamed, whether that be from a weakening labor market or from political pressure or both. Then it got amplified by some market mechanisms such as physical delivery shortages.

Take a look at Silver futures. It has gone nearly vertical over the past week. I won’t be surprised at all if price sees some moderate pullback from here especially in the new year.

Gold is relatively more tamed, but if price meaningfully came back below the prior ATH level made in Oct 2025, there could mean potential for even larger pullback.

The Ephemeral Tourist

December 28th. 2025 @ 9:43pm CST