This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

I had some slack over the holiday weekend but still wants to put something in to keep the cadence alive so I’ll be very brief.

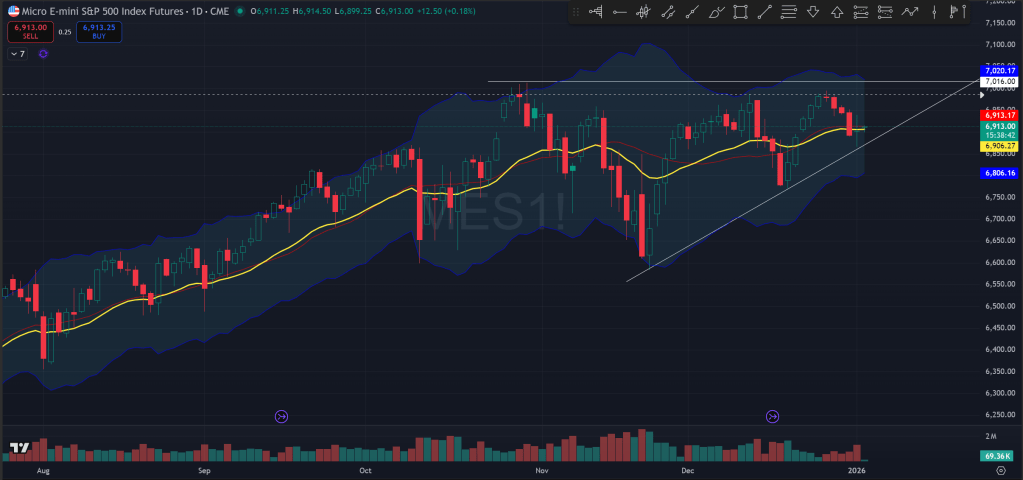

Over the last week which was also partly the final week of 2025, equities were in general malaise as a gradual sell-off took SPX back below ATH levels.

This is largely unsurprising to me as I expected some near term turbulence especially after a rather quick rally leading up to Christmas.

Note how the sell-off poked below the 21EMA on the daily briefly but never really materially closed below it and bounced in the first trading day of 2026.

So far my base case is still for price to resolve higher in the short term as there are no signs of anything changing significantly, except maybe some geopolitical noise over the weekend that frankly we’ve all seen way more dramatic things over the past few years.

Flipping to the futures chart we can see that price due to rolling never cleared the prior ATH made in late October. So naturally that appears to be a visible target that people might anchor to. This is only about 1.7% above where we are on Sunday after the overnight open, so we could realistically get there this week.

What happens afterward could be either a quick rejection, which could indicate more time needs to be spent in this developing larger range as participants wait for new signals and events and data while also people take profits potentially in the new year.

Or it could see a wave of chasing longs quickly push price higher to establish a breakout. Depending on the strength and whether there is any kind of macro trigger this could be long-lasting or fail resulting a failure and back in range.

We will know when we see it.

The Ephemeral Tourist

January 5th. 2026 @ 12:28am CST