This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Over the first full week of trading in the new year, equities made good progress building on the momentum. SPX poked higher and closed out the week making new all time highs.

On Monday, we had ISM manufacturing index which came in lower than expected while Wednesday’s services index was higher than expected. We also had labor market data including ADP, JOLTS and the non-farm payrolls data on Friday, all confirming the cooling of the labor market.

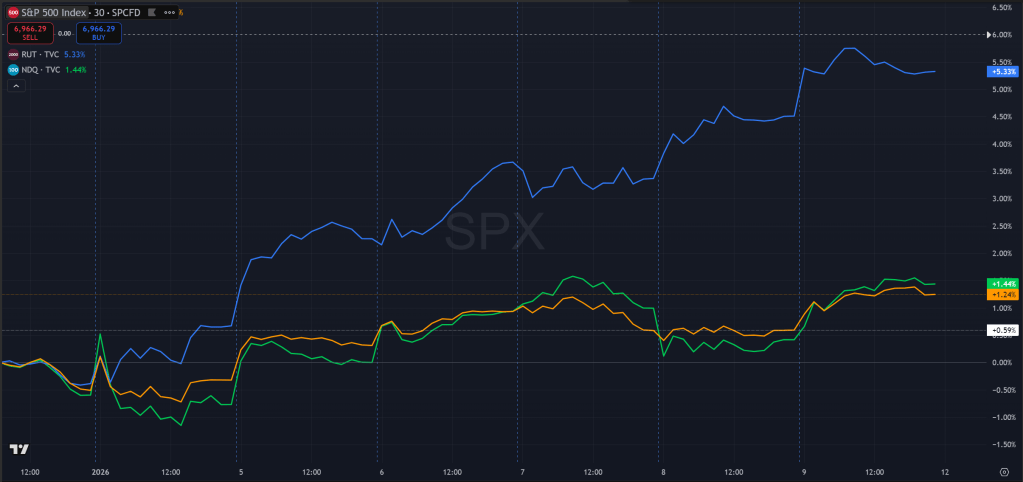

Of note is the outperformance in small caps relative to the high flying mega-cap tech stocks. This could be the result of oil stocks performing well following developments in Venezuela and subsequent prospect for US oil companies.

This relative performance spread is also evident in that SPX and RUT are both at or making new ATH while NDQ is still about 1.5% below the prior ATH made in late Oct of 2025, and is being pinned by highs made in December.

Also over the past week, gold and silver had some notable volatility but still ended the week higher than the previous. This could also be due to those geopolitical happenings in Venezuela and Iran. There is also some saying about Bloomberg commodity index rebalancing that could introduce selling in metals, so I won’t be surprised if there are quick sell-offs to reset in the immediate future.

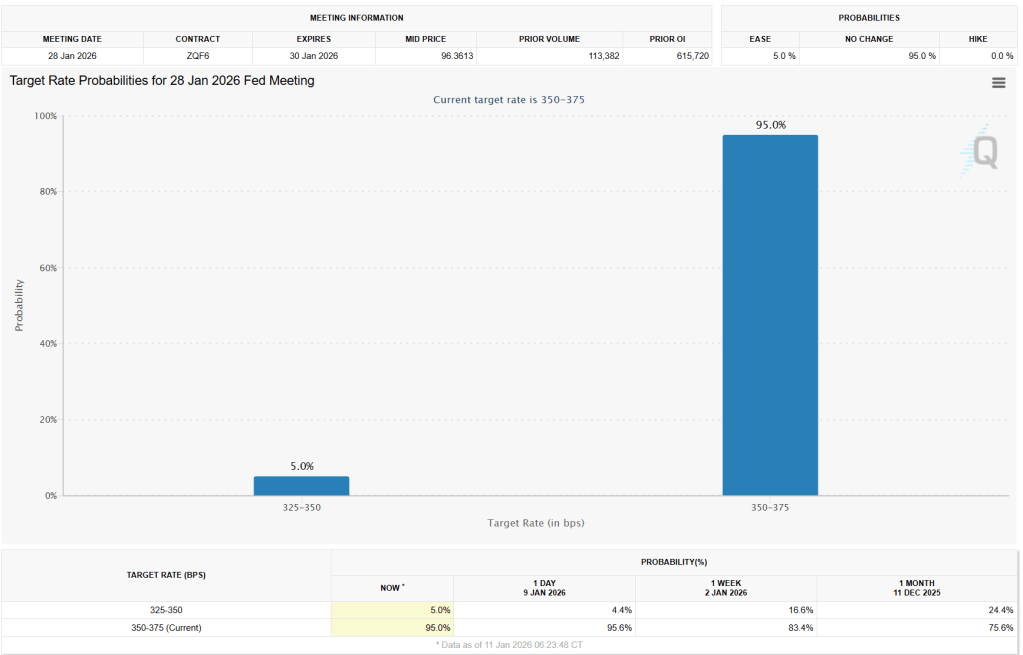

Next week, we are getting the highly anticipated CPI data which could trigger a readjustment of the Fed cutting anticipation. Right now the base case is for the Fed to hold the rates steady in the Jan meeting as they wait for more data to confirm inflation is on a sustained downward path.

To summarize, the base case for equities still is higher. There could be a more sustained period of rotation from the winners of 2025 to losers in the coming weeks. Geopolitics happenings in Venezuela and Iran as well as elsewhere in the world could also bring about shifts that mainly impact commodities. We are also due to enter earnings season starting with banks reporting next week, which would be the next source of market moving catalyst.

The Ephemeral Tourist

January 11th. 2026 @ 6:48pm CST