This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Over the past week, major equity indexes generally performed rather poorly. This malaise was mostly caused by weakness in the tech software stocks and banking stocks, which had earnings this past week. The bright spots were hardware tech companies like those chip stocks and memory stocks.

There was seemingly some change in Trump’s Fed president pick frontrunner. Kevin Hassett was widely regarded as the frontrunner for the pick but this week he floated that he might want to keep him in the WH instead of putting him in the Fed. This raised odds for the other Kevin- Kevin Warsh to be the incoming Fed chair. Warsh is generally viewed as more hawkish and less likely to be strongly influenced by Trump so yields rose over the last week.

Additionally, the DOJ investigation into the Fed also sort of complicated things a bit, sparking some pushback while also creating uncertainty whether the Fed independence might be in serious peril or perhaps we could see a new Fed chair sooner than expected.

The SCOTUS did not release any ruling on the tariff case during Wednesday 1/14 opinion day. The next release day will be tomorrow 1/20. If the tariff ruling was not released tomorrow it might not be at least another month for the next potential opinion day according to some sources.

Last week also saw some more geopolitical uncertainties.

In the first half of the week, the situation in Iran looked to be very volatile, sparking rallied in crude oil. This changed midweek as Trump held off direct intervention in Iran, causing a sell-off in crude oil later in the week.

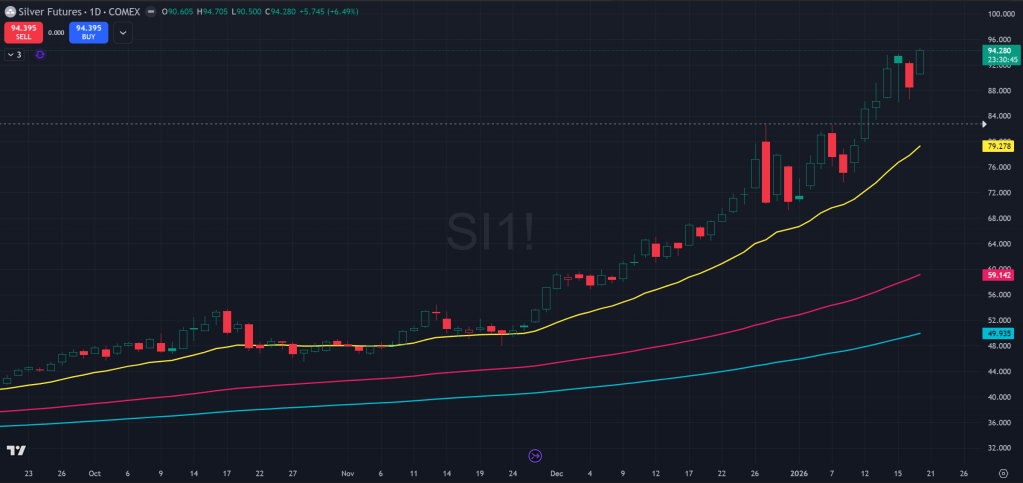

Another development is the administration’s harder push to acquire Greenland. EU countries responded by sending troops over to Greenland while Trump threatened tariffs on EU countries if they block the bid for Greenland. This apparently created some amount of geopolitical fear over the weekend, as equities opened lower on Sunday overnight while gold and silver rallied, despite Trump earlier in the week holding off tariffs on materials import.

CPI and PPI both came in mostly meeting expectations. Retail sales were slightly above expectation. Jobless claims were slightly below expectation.

Shifting to the coming week, more companies will be reporting earnings but the season won’t be in high gear until the week after when big tech companies are slated to report.

I think over this holiday shortened week, a key point to watch will be what happens to Greenland and how the EU and US administration will escalate or deescalate. Additionally people will be watching tomorrow’s SCOTUS to see if there will be a ruling on tariffs. 3Q GDP and PCE will also be released this week for added clarity into the state of the economy and inflation.

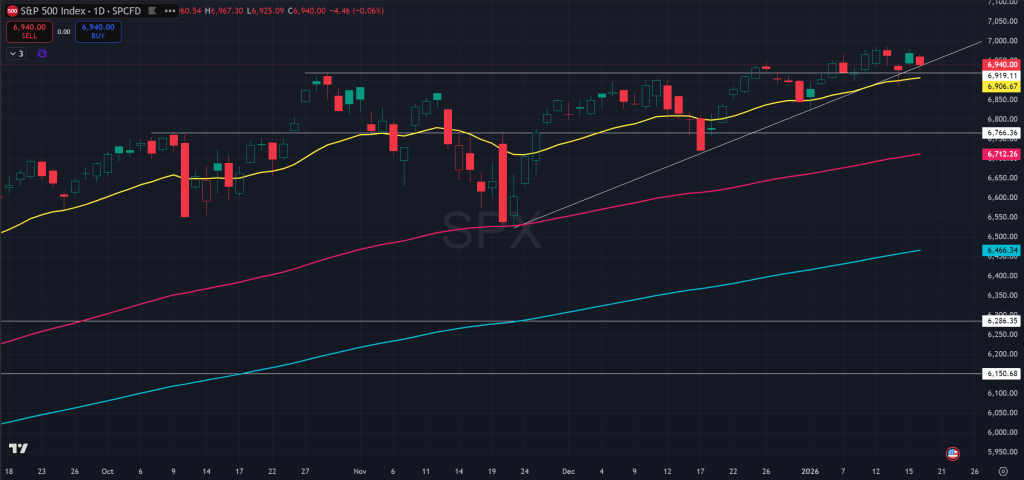

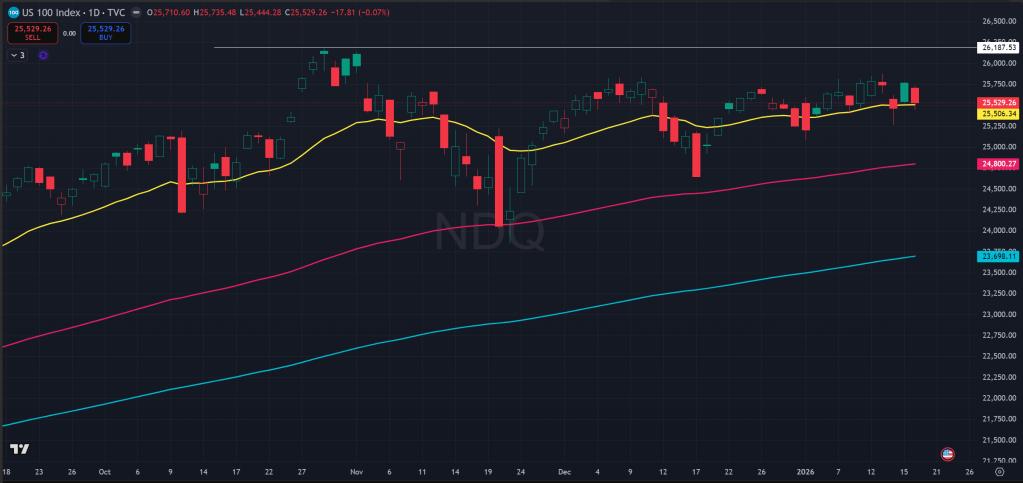

Price wise, I think it’s crucial to see if for equities, price is able to continue to hold above the moving averages on the daily chart. So far price has been holding above the 21EMA even for NDQ on rotation. SPX has spent more than a week above prior ATH in Oct 2025 so the longer it stays above that the higher the chance for price to be able to resolve to higher.

Regarding precious metals, apparently gold and silver both continued to make new all time highs, defying any naysayers talking about over-extension.

My personal opinion is that yes there is a structural support for long term appreciation for gold and silver and copper even, due to the fact that the Fed and other central banks might need to continue easing even if inflation’s on the rise, but I’d still much prefer not to get involved when the rise has gone for a while and with increased volatility, especially in silver as vol increased over the past month. I’d much rather not to get rug pulled, especially when I’m attempting to invest and not exactly trying to trade (I have no edge over dedicated commodities and precious metals traders).

The Ephemeral Tourist

January 19th. 2026 @ 4:29pm CST