This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Over the past short week, there were a few notable stories. One of the bigger one was the TACO on Greenland during the Davos meeting.

On Wednesday, he first said in the morning that the US was not going take Greenland by force. Then later in the afternoon he said that no tariff will be imposed on Feb 1st against EU countries because a good framework over Greenland between the US and EU has been reached, without giving any sort of details.

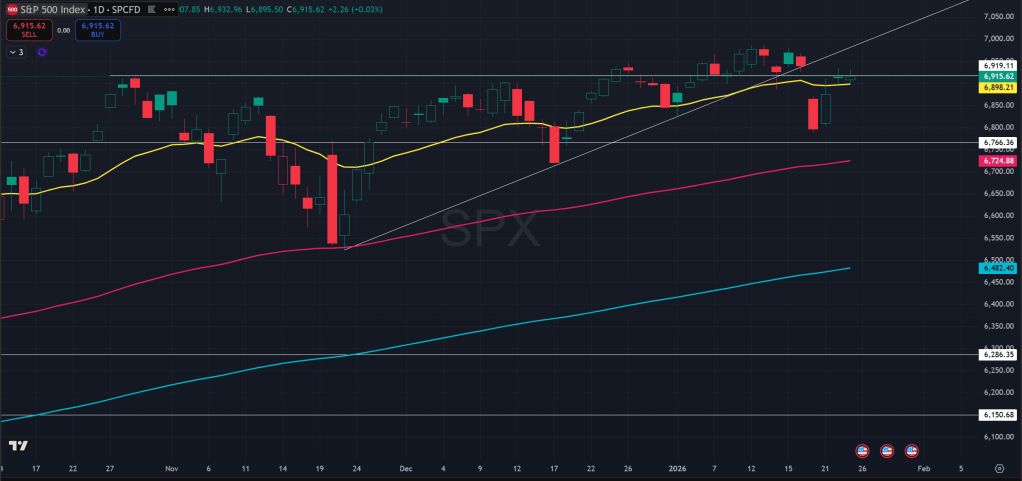

Markets cheered on this news and almost fully recovered the sell-off from Sunday overnight to Tuesday. For SPX, this meant that price closed near the 21 EMA on Wednesday and above it on Thursday and Friday after closing below it on Tuesday.

Of note though the momentum from the bounce has waned significantly over Thursday and Friday, meaning that this bounce is at risk of rejection from the 6920 level, and if that happens the outlook shifts considerably more bearish in the short term.

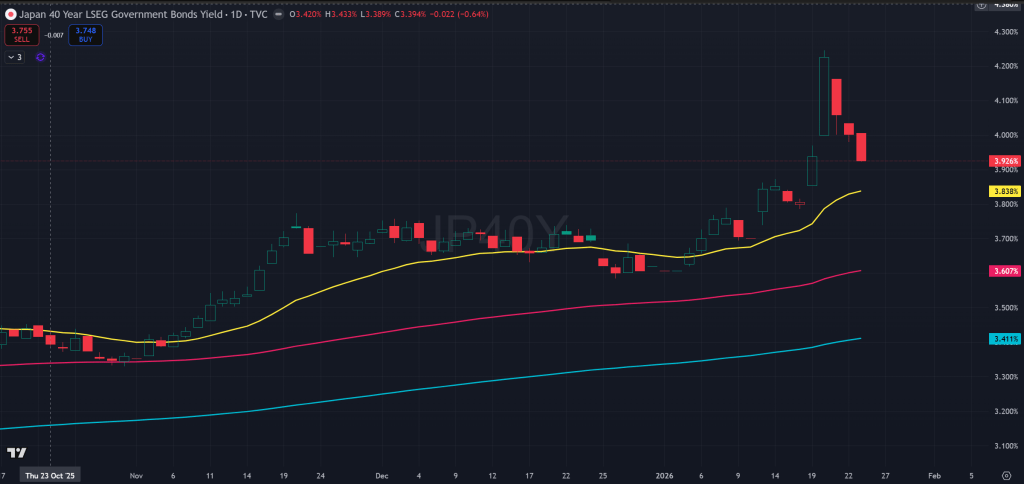

In addition to the TACO story this past week, Japan bond market rout on Monday and especially on Tuesday also took headlines. Japan 40 year bond yields jumped nearly 40bps over 2 days and then subsequently yields dropped back down to Monday levels from Wednesday to Friday.

This apparently is due to Japan PM’s plan to promote government spending and unfunded tax cuts, exacerbating concerns over Japan’s already substantial debt issue, with some comparing this with UK’s Liz Truss momentum a few years back.

This Japan bond rout also likely weighed on the carry trade aspects a bit as it did in the past. If Yen yields are higher, the spread between Yen yields and US yields narrows, meaning it’s less profitable to borrow in Yen and invest in USD, leading to potential de-risking in global and USD assets. But apparently, this episode was rather short lived and BOJ held rates steady as expected on Friday as well.

Shifting back to the US markets. It’s fair to say that SPX at the end of this week still looks to be in a state of balance. Next week we will be getting quite a few potential catalysts that could break this balance, including the Fed rate announcement and a slew of heavy weight tech earnings.

INTC reported this past week and was heavily punished by the lackluster guidance due to their production constraints, making them unable to meet the strong demands for chips.

Similarly, there is now growing concern or maybe I should say attention over memory storage shortage. I’ve heard news about all production for 2026 being booked and price increases over 100% and potentially impacting smart phones and PC pricing. This is all against the backdrop of the increasing demand to build data centers to fulfill the ever growing AI needs and could also bring about shortage of power supply chains.

I think people will be heavily focused on these aspects for the key tech earnings next week.

A final word on commodities. Gold and silver continued to rally this week. I think this imbalance is still active right now but from the perspective of looking to invest I just don’t think it’s a good idea to be chasing this, as it could quickly reverse if there is some catalyst, but long term I continue to think there is a structural support for this to go up, but just don’t want to get involved right now.

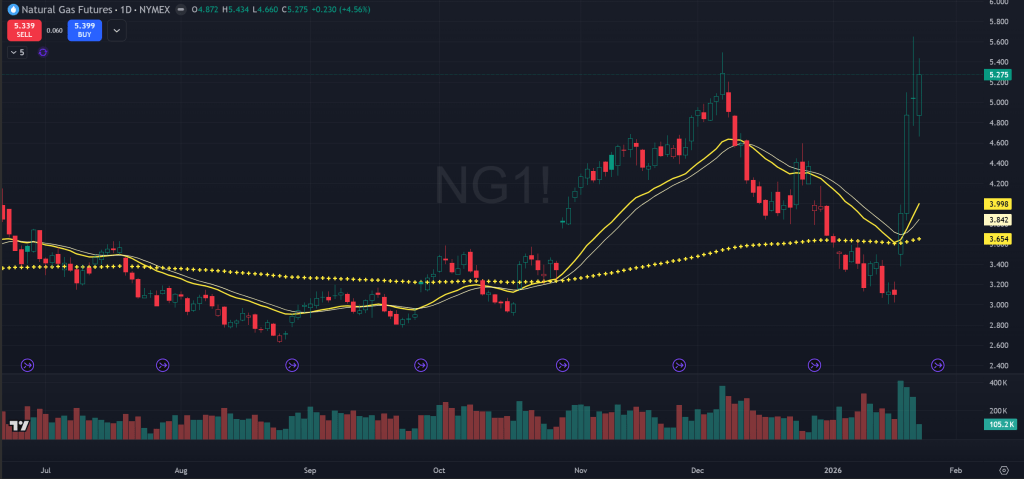

Natural gas had a huge rally over the first half of the week on the prospect of monster winter storm sweeping across the US and the deep freeze that impacted a bunch of northern states. In Chicago we largely missed out on the heavy snow and icing event but the cold was definitely real. The idea of moving to California at some point in the future is certainly growing very attractive to me.

The Ephemeral Tourist

January 25th. 2026 @ 1:19pm CST