This serves as a recap for myself and is not to be viewed as any kind of trade suggestion. All views expressed are my own.

Price continued higher over the short trading week and maintained consecutive higher lows. This in general is indicative of strong bullish action.

Of note, Tuesday formed a small inside bar but sellers weren’t able to overwhelm buying activity and price closed with a small bull body. On subsequent days, price marched higher. Thursday was a short trading day and was interesting as it made an open gap up and continued higher through the day.

There is a possibility that this marks a local top for the time being as price could have made a climactic high on Thursday. Later that day after markets closed early, the OBBB was passed and sent to the president. So the rally in the morning could be from anticipation of the bill’s passing.

It is relatively straightforward now that for price to be possibly reversing the bull trend it currently finds itself in, the first thing that must happen is a lower low to indicate sufficient selling activity.

Given the strength of the trend and consecutive bull bars without much overlap, if there happens to be a dip next week, I would expect first dip to be buyable to test the high. Price would then likely to migrate into a chop to build a flag before selecting the next direction.

But until that happens, the trend is pointing higher and intraday dips would likely present buying opportunities. It will work until it doesn’t.

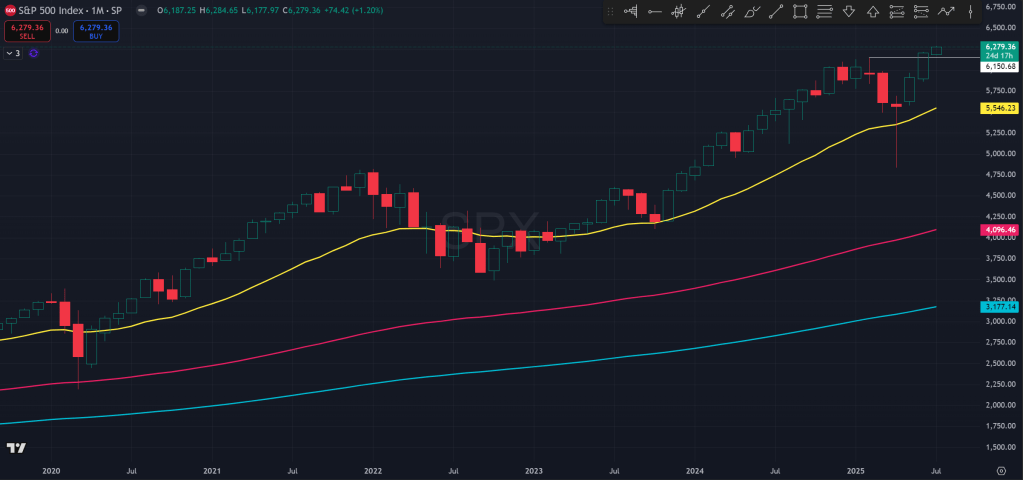

Also touching on the monthly chart a bit. It is fairly obvious that price made 2 consecutive strong bull trend bars in May and June following a very strong bull reversal bar in Apr with a significant tail. This in general is again pointing to continuation of the bull trend, after a test of the 21 EMA on the monthly chart.

Like on the daily chart, there is currently no reason to be calling for a market top, unless price made a lower low or if maybe price closed under the Feb 2025 high in July, forming some kind of bearish reversal bar, which would then make a higher high double top possible and potentially a failed breakout. The month is still young and anything could happen, but like on the daily chart, buying dips to trade the bull trend will work until it doesn’t.

The Ephemeral Tourist

July 6th. 2025 @ 11:03pm CST